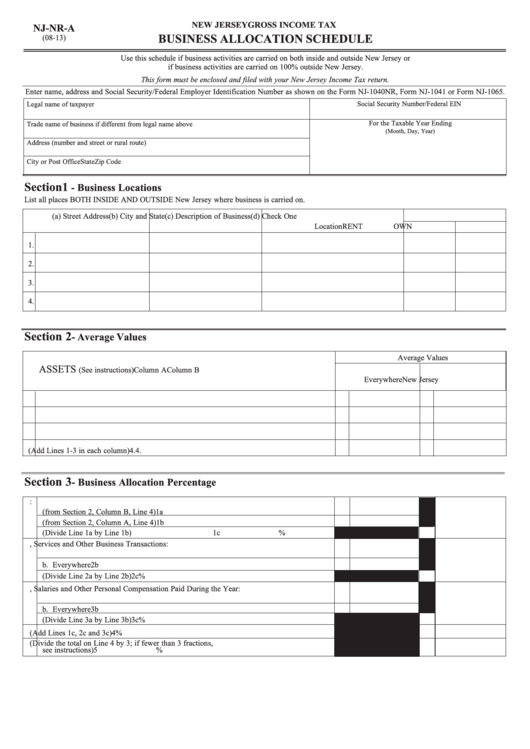

NEW JERSEY GROSS INCOME TAX

NJ-NR-A

(08-13)

BUSINESS ALLOCATION SCHEDULE

Use this schedule if business activities are carried on both inside and outside New Jersey or

if business activities are carried on 100% outside New Jersey.

This form must be enclosed and filed with your New Jersey Income Tax return.

Enter name, address and Social Security/Federal Employer Identification Number as shown on the Form NJ-1040NR, Form NJ-1041 or Form NJ-1065.

Social Security Number/Federal EIN

Legal name of taxpayer

For the Taxable Year Ending

Trade name of business if different from legal name above

(Month, Day, Year)

Address (number and street or rural route)

City or Post Office

State

Zip Code

Section 1

- Business Locations

List all places BOTH INSIDE AND OUTSIDE New Jersey where business is carried on.

(a) Street Address

(b) City and State

(c) Description of Business

(d) Check One

Location

RENT

OWN

1.

2.

3.

4.

Section 2

- Average Values

Average Values

ASSETS

(See instructions)

Column A

Column B

Everywhere

New Jersey

1. Real Property Owned

1.

1.

2. Real and Tangible Property Rented

2.

2.

3. Tangible Personal Property Owned

3.

3.

4. TOTALS (Add Lines 1-3 in each column)

4.

4.

Section 3

- Business Allocation Percentage

1. Average Values of Property:

a. In New Jersey (from Section 2, Column B, Line 4)

1a

b. Everywhere (from Section 2, Column A, Line 4)

1b

c. Percentage in New Jersey. (Divide Line 1a by Line 1b)

1c

%

y

2. Total Receipts from All Sales, Services and Other Business Transactions:

a. In New Jersey

2a

b. Everywhere

2b

c. Percentage in New Jersey (Divide Line 2a by Line 2b)

2c

%

3. Wages, Salaries and Other Personal Compensation Paid During the Year:

a. In New Jersey

3a

b. Everywhere

3b

c. Percentage in New Jersey. (Divide Line 3a by Line 3b)

3c

%

4. Sum of New Jersey Percentages. (Add Lines 1c, 2c and 3c)

4

%

5. Business Allocation Percentage. (Divide the total on Line 4 by 3; if fewer than 3 fractions,

see instructions)

5

%

1

1 2

2 3

3