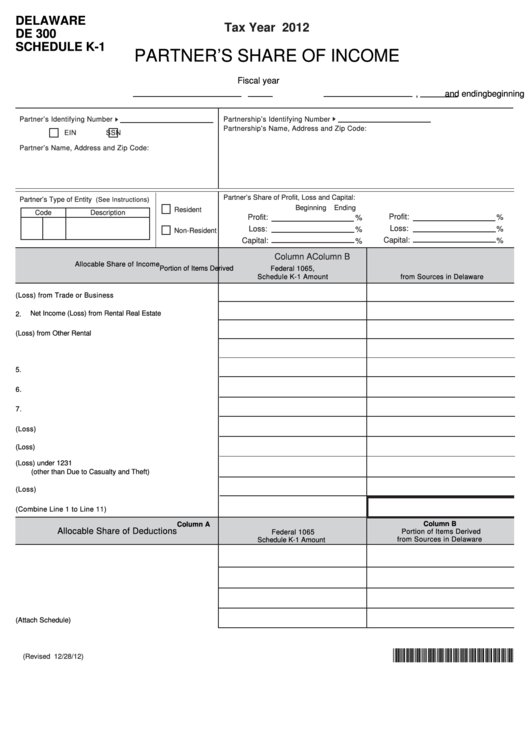

DELAWARE

Reset

Tax Year 2012

DE 300

Print Form

SCHEDULE K-1

PARTNER’S SHARE OF INCOME

Fiscal year

beginning

,

,

and ending

,

Partner’s Identifying Number

Partnership’s Identifying Number

Partnership’s Name, Address and Zip Code:

EIN

SSN

Partner’s Name, Address and Zip Code:

Partner’s Share of Profit, Loss and Capital:

Partner’s Type of Entity

(See Instructions)

Beginning

Ending

Resident

Code

Description

Profit:

Profit:

%

%

Loss:

Loss:

%

%

Non-Resident

Capital:

Capital:

%

%

Column A

Column B

Allocable Share of Income

Federal 1065,

Portion of Items Derived

Schedule K-1 Amount

from Sources in Delaware

1.

Ordinary Income (Loss) from Trade or Business Activities...

Net Income (Loss) from Rental Real Estate Activities.........

2.

3.

Net Income (Loss) from Other Rental Activities.................

4.

Guaranteed Payment to Partner......................................

5.

Interest...........................................................................

6.

Dividends........................................................................

7.

Royalties.........................................................................

8.

Net Short-term Capital Gain (Loss)..................................

9.

Net Long-term Capital Gain (Loss)...................................

10. Net Gain (Loss) under 1231

(other than Due to Casualty and Theft)............................

11. Other Income (Loss).......................................................

12. Total Income (Combine Line 1 to Line 11).........................

Column B

Column A

Allocable Share of Deductions

Portion of Items Derived

Federal 1065

from Sources in Delaware

Schedule K-1 Amount

13. Charitable Contributions.................................................

14. Section 179 Expense Deductions....................................

15. Expenses from Portfolio Income......................................

16. Other Deduction/Credits (Attach Schedule)....................

*DF30112019999*

(Revised 12/28/12)

1

1