Form Rv-F1307201 - Bond Of Warehousemen, Dealers, Wholesaler, And/or Manufacturers Of Beer Or Any Other Such Beverage Used As A Measure Of The Tax Levied Under Chapter 5 Of Title 57 Inclusive, Tennessee Code Annotated

ADVERTISEMENT

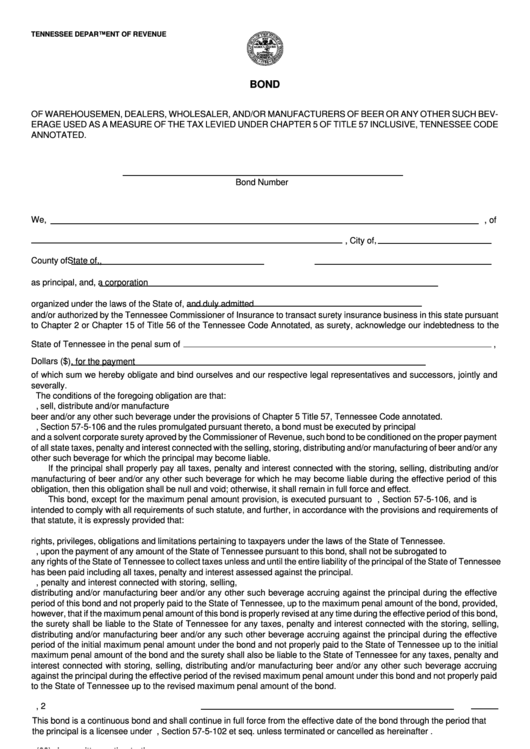

TENNESSEE DEPARTMENT OF REVENUE

BOND

OF WAREHOUSEMEN, DEALERS, WHOLESALER, AND/OR MANUFACTURERS OF BEER OR ANY OTHER SUCH BEV-

ERAGE USED AS A MEASURE OF THE TAX LEVIED UNDER CHAPTER 5 OF TITLE 57 INCLUSIVE, TENNESSEE CODE

ANNOTATED.

Bond Number

We,

, of

, City of

,

County of

State of,

,

as principal, and

, a corporation

organized under the laws of the State of

, and duly admitted

and/or authorized by the Tennessee Commissioner of Insurance to transact surety insurance business in this state pursuant

to Chapter 2 or Chapter 15 of Title 56 of the Tennessee Code Annotated, as surety, acknowledge our indebtedness to the

State of Tennessee in the penal sum of

,

Dollars ($

), for the payment

of which sum we hereby obligate and bind ourselves and our respective legal representatives and successors, jointly and

severally.

The conditions of the foregoing obligation are that:

1. Principal has applied to the State of Tennessee for Certificate of Registration to store, sell, distribute and/or manufacture

beer and/or any other such beverage under the provisions of Chapter 5 Title 57, Tennessee Code annotated.

2. Pursuant to T.C.A., Section 57-5-106 and the rules promulgated pursuant thereto, a bond must be executed by principal

and a solvent corporate surety aproved by the Commissioner of Revenue, such bond to be conditioned on the proper payment

of all state taxes, penalty and interest connected with the selling, storing, distributing and/or manufacturing of beer and/or any

other such beverage for which the principal may become liable.

If the principal shall properly pay all taxes, penalty and interest connected with the storing, selling, distributing and/or

manufacturing of beer and/or any other such beverage for which he may become liable during the effective period of this

obligation, then this obligation shall be null and void; otherwise, it shall remain in full force and effect.

This bond, except for the maximum penal amount provision, is executed pursuant to T.C.A., Section 57-5-106, and is

intended to comply with all requirements of such statute, and further, in accordance with the provisions and requirements of

that statute, it is expressly provided that:

1. Both the principal and surety under this bond shall be considered the taxpayers as to the State of Tennessee with all

rights, privileges, obligations and limitations pertaining to taxpayers under the laws of the State of Tennessee.

2. The surety, upon the payment of any amount of the State of Tennessee pursuant to this bond, shall not be subrogated to

any rights of the State of Tennessee to collect taxes unless and until the entire liability of the principal of the State of Tennessee

has been paid including all taxes, penalty and interest assessed against the principal.

3. The surety shall be liable to the State of Tennessee for any taxes, penalty and interest connected with storing, selling,

distributing and/or manufacturing beer and/or any other such beverage accruing against the principal during the effective

period of this bond and not properly paid to the State of Tennessee, up to the maximum penal amount of the bond, provided,

however, that if the maximum penal amount of this bond is properly revised at any time during the effective period of this bond,

the surety shall be liable to the State of Tennessee for any taxes, penalty and interest connected with the storing, selling,

distributing and/or manufacturing beer and/or any such other beverage accruing against the principal during the effective

period of the initial maximum penal amount under the bond and not properly paid to the State of Tennessee up to the initial

maximum penal amount of the bond and the surety shall also be liable to the State of Tennessee for any taxes, penalty and

interest connected with storing, selling, distributing and/or manufacturing beer and/or any other such beverage accruing

against the principal during the effective period of the revised maximum penal amount under this bond and not properly paid

to the State of Tennessee up to the revised maximum penal amount of the bond.

, 2

4. The effective date of this bond shall be

This bond is a continuous bond and shall continue in full force from the effective date of the bond through the period that

the principal is a licensee under T.C.A., Section 57-5-102 et seq. unless terminated or cancelled as hereinafter .

5. Surety may cancel this bond and be relieved of further liability hereon by giving sixty (60) days written notice to the

Tennessee Department of Revenue, Taxpayer Services Division, Andrew Jackson State Office Building, Nashville, Tennessee

37242, but such cancellation shall not affect any liability incurred or accrued hereunder prior to the termination of the notice

period.

6. It is specifically understood and agreed that the principal and surety under this bond are liable pursuant to the provisions

of this bond, including, but not limited to the maximum penal amount set forth herein, notwithstanding any provisions of T.C.A.,

Section 57-5-106, regarding maximum penal amounts, to the contrary.

INTERNET (4-03)

RV-F1307201 (Rev. 4-03)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2