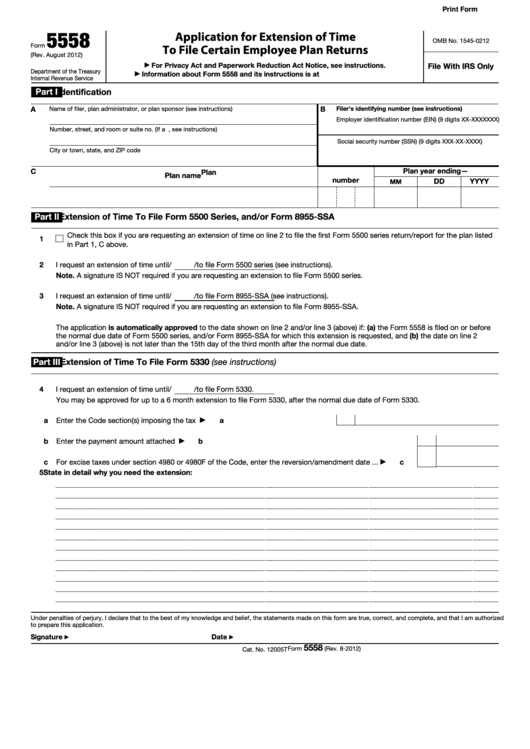

Print Form

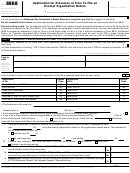

5558

Application for Extension of Time

OMB No. 1545-0212

Form

To File Certain Employee Plan Returns

(Rev. August 2012)

For Privacy Act and Paperwork Reduction Act Notice, see instructions.

File With IRS Only

▶

Department of the Treasury

Information about Form 5558 and its instructions is at

▶

Internal Revenue Service

Part I

Identification

A

B

Name of filer, plan administrator, or plan sponsor (see instructions)

Filer’s identifying number (see instructions)

Employer identification number (EIN) (9 digits XX-XXXXXXX)

Number, street, and room or suite no. (If a P.O. box, see instructions)

Social security number (SSN) (9 digits XXX-XX-XXXX)

City or town, state, and ZIP code

C

Plan year ending—

Plan

Plan name

number

DD

YYYY

MM

Part II

Extension of Time To File Form 5500 Series, and/or Form 8955-SSA

Check this box if you are requesting an extension of time on line 2 to file the first Form 5500 series return/report for the plan listed

1

in Part 1, C above.

2

I request an extension of time until

/

/

to file Form 5500 series (see instructions).

Note. A signature IS NOT required if you are requesting an extension to file Form 5500 series.

3

I request an extension of time until

/

/

to file Form 8955-SSA (see instructions).

Note. A signature IS NOT required if you are requesting an extension to file Form 8955-SSA.

The application is automatically approved to the date shown on line 2 and/or line 3 (above) if: (a) the Form 5558 is filed on or before

the normal due date of Form 5500 series, and/or Form 8955-SSA for which this extension is requested, and (b) the date on line 2

and/or line 3 (above) is not later than the 15th day of the third month after the normal due date.

Part III

Extension of Time To File Form 5330 (see instructions)

4

I request an extension of time until

/

/

to file Form 5330.

You may be approved for up to a 6 month extension to file Form 5330, after the normal due date of Form 5330.

a

Enter the Code section(s) imposing the tax

.

.

.

.

.

.

.

.

.

.

.

a

▶

b

Enter the payment amount attached .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

b

▶

c

For excise taxes under section 4980 or 4980F of the Code, enter the reversion/amendment date .

.

.

c

▶

5

State in detail why you need the extension:

Under penalties of perjury, I declare that to the best of my knowledge and belief, the statements made on this form are true, correct, and complete, and that I am authorized

to prepare this application.

Signature

Date

▶

▶

5558

Form

(Rev. 8-2012)

Cat. No. 12005T

1

1 2

2 3

3