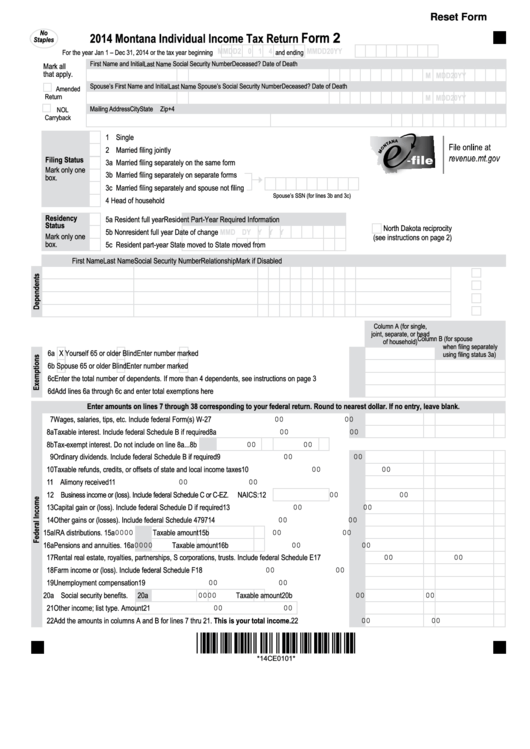

Reset Form

No

Form 2

2014 Montana Individual Income Tax Return

Staples

M M D D 2 0 1 4

M M D D 2 0 Y Y

For the year Jan 1 – Dec 31, 2014 or the tax year beginning

and ending

First Name and Initial

Last Name

Social Security Number

Deceased? Date of Death

Mark all

that apply.

M M D D 2 0 Y Y

Spouse’s First Name and Initial

Spouse’s Social Security Number

Deceased? Date of Death

Last Name

Amended

Return

M M D D 2 0 Y Y

Mailing Address

City

State Zip+4

NOL

Carryback

1 Single

2 Married filing jointly

Filing Status

3a Married filing separately on the same form

Mark only one

3b Married filing separately on separate forms

box.

3c Married filing separately and spouse not filing

Spouse’s SSN (for lines 3b and 3c)

4 Head of household

Residency

5a Resident full year

Resident Part-Year Required Information

Status

North Dakota reciprocity

5b Nonresident full year

Date of change

M M D D Y Y Y Y

Mark only one

(see instructions on page 2)

box.

5c Resident part-year

State moved to

State moved from

First Name

Last Name

Social Security Number

Relationship

Mark if Disabled

Column A (for single,

joint, separate, or head

Column B (for spouse

of household)

when filing separately

6a X Yourself

65 or older

Blind

Enter number marked ...........

6a

using filing status 3a)

6b

Spouse

65 or older

Blind

Enter number marked ...........

6b

6c Enter the total number of dependents. If more than 4 dependents, see instructions on page 3 ............

6c

6d Add lines 6a through 6c and enter total exemptions here ......................................................................

6d

Enter amounts on lines 7 through 38 corresponding to your federal return. Round to nearest dollar. If no entry, leave blank.

7 Wages, salaries, tips, etc. Include federal Form(s) W-2 .........................................................................

7

00

00

8a Taxable interest. Include federal Schedule B if required ........................................................................

8a

00

00

8b Tax-exempt interest. Do not include on line 8a ...

8b

00

00

9 Ordinary dividends. Include federal Schedule B if required ....................................................................

9

00

00

10 Taxable refunds, credits, or offsets of state and local income taxes ......................................................

10

00

00

11 Alimony received ....................................................................................................................................

11

00

00

.......

12 Business income or (loss). Include federal Schedule C or C-EZ.

NAICS:

12

00

00

13 Capital gain or (loss). Include federal Schedule D if required ................................................................

13

00

00

14 Other gains or (losses). Include federal Schedule 4797 .........................................................................

14

00

00

15a IRA distributions.

15a

00

00

Taxable amount ........ 15b

00

00

16a Pensions and annuities.

16a

00

00

Taxable amount ........ 16b

00

00

17 Rental real estate, royalties, partnerships, S corporations, trusts. Include federal Schedule E .............

17

00

00

18 Farm income or (loss). Include federal Schedule F ................................................................................

18

00

00

19 Unemployment compensation ................................................................................................................

19

00

00

20a Social security benefits. 20a

00

00

Taxable amount ......... 20b

00

00

21 Other income; list type.

Amount ............

21

00

00

22 Add the amounts in columns A and B for lines 7 thru 21. This is your total income. ...........................

22

00

00

*14CE0101*

*14CE0101*

1

1 2

2 3

3