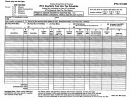

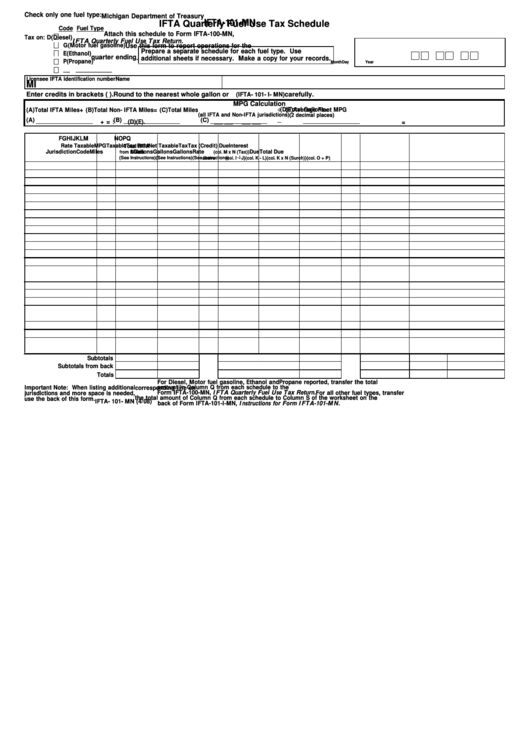

Check only one fuel type:

Michigan Department of Treasury

IFTA-101-MN

IFTA Quarterly Fuel Use Tax Schedule

Code Fuel Type

Attach this schedule to Form IFTA-100-MN,

Tax on:

D

(Diesel)

IFTA Quarterly Fuel Use Tax Return.

G

(Motor fuel gasoline)

Use this form to report operations for the

Prepare a separate schedule for each fuel type. Use

E

(Ethanol)

quarter ending

.

additional sheets if necessary. Make a copy for your records.

P

(Propane)

Month

Day

Year

__ ___________

Licensee IFTA identification number

Name

MI

Enter credits in brackets ( ). Round to the nearest whole gallon or mile. Read instructions

(IFTA-101-I-MN)

carefully.

MPG Calculation

(E) Average Fleet MPG

:

(D) Total Gallons

=

(A) Total IFTA Miles

+

(B) Total Non-IFTA Miles =

(C) Total Miles

(all IFTA and Non-IFTA jurisdictions)

(2 decimal places)

(A)

(B)

(C)

+

=

:

(D)

=

(E)

.

___ ___

___ ___

F

G

H

I

J

K

L

M

N

O

P

Q

Rate

Taxable

MPG

Taxable

Tax Paid

Net Taxable

Tax

Tax (Credit) Due

Interest

Total IFTA

Jurisdiction

Code

Miles

Gallons

Gallons

Gallons

Rate

Due

Total Due

Miles

from E

(col. M x N (Tax) )

:

(See Instructions)

(See Instructions)

above

(col. I J)

(See Instructions)

(col. K - L)

(col. K x N (Surch) )

(col. O + P)

Subtotals

Subtotals from back

Totals

For Diesel, Motor fuel gasoline, Ethanol andPropane reported, transfer the total

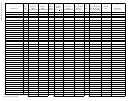

Important Note: When listing additional

amount in Column Q from each schedule to the

corresponding line on

Form IFTA-100-MN, IFTA Quarterly Fuel Use Tax Return. For all other fuel types, transfer

jurisdictions and more space is needed,

the total amount of Column Q from each schedule to Column S of the worksheet on the

use the back of this form.

IFTA-101-MN (4/08)

back of Form IFTA-101-I-MN, Instructions for Form IFTA-101-MN.

1

1 2

2 3

3 4

4