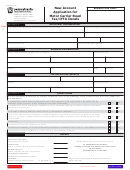

Form Rev-1026 - Information Concerning Motor Carriers Road Tax And International Fuel Tax Agreement Page 2

ADVERTISEMENT

EXEMPTIONS:

Exemption from Motor Carriers Road Tax and Decal/Cab Card Requirements (IFTA):

1. Exempt Operating Entities. The following entities operating qualified motor vehicles are exempt from

PA-MCRT/IFTA road taxes for any travel within this Commonwealth Additionally, such entities are not

required to carry PA-MCRT credentials if they travel exclusively in PA:

l

U.S. Government

l

Commonwealth of Pennsylvania and its political subdivisions

l

Other states and their political subdivisions

l

Provincial governments and territories of Canada

l

Any motor carrier who first obtains authorization from the PA State Police to operate a specific

qualified motor vehicle in Pennsylvania for emergency repairs. The exemption is limited to trip

and return trip only.

l

PA rural electric cooperatives

l

Volunteer fire companies

l

Volunteer ambulance associations

l

Volunteer rescue squads

l

Non-profit non-public schools (K-12)

l

An unladen or towed motor vehicle or unladen trailer which enters this Commonwealth solely for

the purpose of securing repairs or reconditioning. The repair facility shall furnish to the motor

carrier a certificate to be carried by the vehicle operator while the vehicle is in Pennsylvania.

2. Regarding out-of-state travel requirements. Any carrier that operates a qualified motor vehicle in a

state outside of Pennsylvania may be required by the laws of such state to pay such state’s motor carri-

ers road tax. In such cases, all taxes will be reported and paid to Pennsylvania as its base state under

IFTA, and such qualified motor vehicles will be required to obtain a PA IFTA decal and IFTA license before

operating in the other state.

GENERAL INFORMATION

If you are required to register under PA-MCRT/IFTA and purchase decals, they will be mailed to you as soon

as your application is processed. Thereafter, you are required to report quarterly, even if no operations are

conducted.

RECORDS: Carriers are required to maintain the following records for four years:

A. Mileage for each vehicle by jurisdiction

B. Fuel purchases for each vehicle by jurisdiction

C. Equipment lists of all qualifying vehicles

NOTE: In addition to maintaining original fuel and mileage documentation, carriers are encouraged to document

each trip utilizing trip sheets or an Individual Vehicle Mileage Record (IFTA-300).

CALCULATION OF FUEL USED:

The amount of fuel consumed in Pennsylvania or any other IFTA jurisdiction shall be equal to the taxable miles

traveled in each jurisdiction divided by the fleet miles per gallon. Miles traveled in PA by exempt entities list-

ed above are considered non taxable miles and should not be included in “PA Taxable Miles” on the IFTA

Quarterly Fuel Tax Schedule (IFTA-101).

TRIP AND TEMPORARY PERMITS:

Trip permits - Any motor carrier in lieu of purchasing decals for motor carriers road tax or IFTA may purchase

a trip permit which shall be valid for a period of five days at a cost of $50. Operations conducted under a trip

permit need not be reported.

Temporary permits - Any IFTA licensee in good standing with the PA Department of Revenue may request a

temporary permit from the Bureau of Motor and Alternative Fuel Taxes to operate a qualifying vehicle for a

30-day period without IFTA decals. Conditions under which a temporary permit will be issued are:

A. Decals were previously requested for additional vehicles and not received by the time the IFTA

licensee was required to operate; or

B. The IFTA licensee is presently applying for additional decals and must operate immediately.

In the case of (A) and (B) above, the Bureau of Motor and Alternative Fuel Taxes will provide the IFTA

licensee, for a fee of $5 per vehicle, with a facsimile transmission identifying the vehicles and the 30-day

period for which temporary operating privileges are being granted. The carrier must carry the temporary per-

mit in each such vehicle operated. Also, the carrier must include such operations in its quarterly report.

Bureau of Motor and Alternative Fuel Taxes

PO Box 280646 l Hbg, PA 17128-0646 l 800.482.4382 l

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2