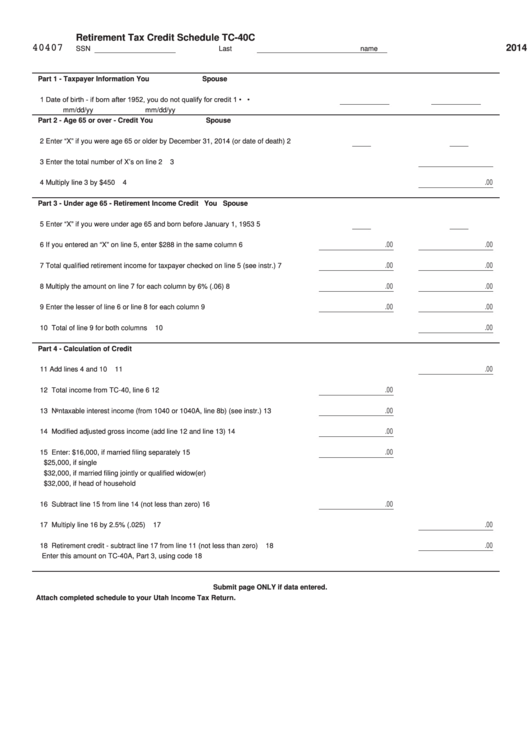

Retirement Tax Credit Schedule

TC-40C

40407

2014

SSN

Last name

USTC ORIGINAL FORM

Part 1 - Taxpayer Information

You

Spouse

mm/dd/yy

mm/dd/yy

Part 2 - Age 65 or over - Credit

You

Spouse

2

Enter “X” if you were age 65 or older by December 31, 2014 (or date of death)

2

3

Enter the total number of X’s on line 2

3

.00

4

Multiply line 3 by $450

4

Part 3 - Under age 65 - Retirement Income Credit

You

Spouse

5

Enter “X” if you were under age 65 and born before January 1, 1953

5

.00

.00

6

If you entered an “X” on line 5, enter $288 in the same column

6

.00

.00

7

Total qualified retirement income for taxpayer checked on line 5 (see instr.)

7

.00

.00

8

Multiply the amount on line 7 for each column by 6% (.06)

8

.00

.00

9

Enter the lesser of line 6 or line 8 for each column

9

.00

10 Total of line 9 for both columns

10

Part 4 - Calculation of Credit

.00

11 Add lines 4 and 10

11

.00

12 Total income from TC-40, line 6

12

.00

13 Nontaxable interest income (from 1040 or 1040A, line 8b) (see instr.)

13

.00

14 Modified adjusted gross income (add line 12 and line 13)

14

.00

15 Enter:

$16,000, if married filing separately

15

$25,000, if single

$32,000, if married filing jointly or qualified widow(er)

$32,000, if head of household

.00

16 Subtract line 15 from line 14 (not less than zero)

16

.00

17 Multiply line 16 by 2.5% (.025)

17

.00

18 Retirement credit - subtract line 17 from line 11 (not less than zero)

18

Enter this amount on TC-40A, Part 3, using code 18

Submit page ONLY if data entered.

Attach completed schedule to your Utah Income Tax Return.

1

1