Form It 511 - Individual Income Tax 500 And 500ez Forms And General Instructions - 2013 Page 6

ADVERTISEMENT

NEW DEVELOPMENTS

continued

HB 318 (O.C.G.A. § 48-7-40.30) The income tax portion of

Code Section 20-2A-3:

•

this bill (Section 6) changes the qualified investor tax credit

Provides that the annual report submitted by the SSOs to the

(also known as the angel investor tax credit)

Department by January 12

th

must also include the total num-

ber of families of scholarship recipients who fall within each

•

Extends the tax credit to qualified investments made in 2014

quartile of Georgia adjusted gross income as defined and re-

and 2015.

ported annually by the Department of Revenue and the aver-

age number of dependents of recipients for each quartile.

•

Provides that the total aggregate amount of all tax credits

•Eliminates the requirement that the Department shall not re-

allowed to qualified investors for qualified investments made

in the 2014 calendar year and claimed and allowed in the

quire any other information from the SSO’s.

2016 taxable year shall not exceed $5 million.

•

Specifies that all information, except the statistical informa-

•

Provides that the total aggregate amount of all tax credits

tion, provided by the SSO’s is confidential.

allowed to qualified investors for qualified investments made

in the 2015 calendar year and claimed and allowed in the

Code Section 48-7-29.16, the qualified education expense

2017 taxable year shall not exceed $5 million. Note: The

credit:

total aggregate amount under current law for calendar years

•Defines “eligible student”.

2011, 2012, and 2013 is $10 million per year.

•

Provides that the credit amount for an individual who is a

The income tax portion of House Bill 318 became effective

member of a limited liability company duly formed under state

upon its approval by the Governor on April 29, 2013.

law, a shareholder of a Subchapter ‘S’ corporation, or a partner

in a partnership, is the amount expended or $10,000.00 per

SB 137 (O.C.G.A. § 48-7-40.1) The income tax portion of

tax year, whichever is less; provided, however, that tax credits

this bill (Section 2) makes changes to the job tax credit for

shall only be allowed for the portion of the income on which

less developed areas. The bill:

such tax was actually paid by such member of the limited

liability company, shareholder of a Subchapter ‘S’ corpora-

•

Changes the term “comprised” to “composed” in subsec-

tion, or partner in a partnership.

tion (c).

•

Specifies that the tax credit shall not be allowed if the tax-

•

Gives the Commissioner of Economic Development, the

payer designated the taxpayer’s qualified education expense

authority to designate along with the Commissioner of Com-

for the direct benefit of any particular individual, whether or not

munity Affairs less developed areas described in subsec-

such individual is a dependent of the taxpayer.

tions (c)(1), (c)(3) and (c)(4). Under current law, only the

Commissioner of Community Affairs makes designations of

•

Provides that in soliciting contributions, an SSO shall not

less developed areas.

represent, or direct a qualified private school to represent, that

in exchange for contributing to the SSO, a taxpayer shall re-

The income tax portion of Senate Bill 137 became effective

ceive a scholarship for the direct benefit of any particular indi-

upon its approval by the Governor on May 6, 2013.

vidual, whether or not such individual is a dependent of the

taxpayer. The status as an SSO shall be revoked for any

such organization which violates this provision.

•

Provides that the annual maximum amount (amount of tax

credits allowed per tax year) shall be $58 million and shall no

longer be adjusted annually using the Consumer Price Index.

•

Provides that the preapproval application must be submitted

electronically to the Department in the manner specified by

the Department.

The income tax portions of House Bill 283 became effective

upon its approval by the Governor on May 7, 2013 and are

applicable to taxable years beginning on or after January 1,

2013.

Page 4

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

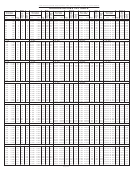

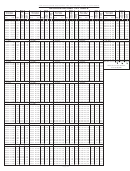

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32