Form It 511 - Individual Income Tax 500 And 500ez Forms And General Instructions - 2013 Page 28

ADVERTISEMENT

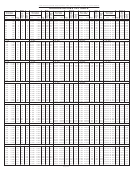

SCHEDULE FOR ESTIMATING GEORGIA INCOME TAXES

(Figures may be rounded off.)

1. Federal Adjusted gross income expected during the current year

$

.

2. Social Security

$

.

(See Line 9 instructions on page 11)

3. Railroad Retirement

$

.

(See Line 9 instructions on page 11)

4. Other deductions

(

$

.

See instructions on pages 11-12)

5. Balance (

$

.

Subtract Lines 2 - 4 from Line 1)

6. Personal exemption and

exemption for dependents

$

.

7. Balance

$

.

(Subtract Line 6 from Line 5)

8. Additions to income

$

.

(See instructions on page 11)

9. Balance

$

.

(Add lines 7 and 8)

10. Applicable Retirement Exclusion

(Worksheet on page 14)

$

.

11. Taxable income

$

.

(Subtract Line 10 from Line 9)

12. Tax on amount on Line 11

$

.

(See Georgia tax rate schedule below)

13. Withholding Tax and other credits

$

.

14. Amount from prior year’s return to

be credited to this year’s estimate

$

.

15. Estimated Tax due this year

$

.

(Subtract Lines 13 and 14 from Line 12) (See 500ES on page 27)

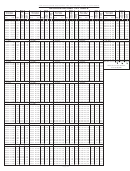

GEORGIA TAX RATE SCHEDULE

SINGLE

If Georgia taxable income is

Amount of Tax is

Not Over $

750 .....................................................

1% of Taxable Income

Over

$

750 ............ But not over ...........$2,250

$

7.50 ............ plus 2% of the amount over............$

750

Over

$ 2,250 ............ But not over ...........$3,750

$ 37.50 ............ plus 3% of the amount over............$ 2,250

Over

$ 3,750 ............ But not over ...........$5,250

$ 82.50 ............ plus 4% of the amount over............$ 3,750

Over

$ 5,250 ............ But not over ...........$7,000

$ 142.50 ............ plus 5% of the amount over............ $ 5,250

Over

$ 7,000 ..............................................

$ 230.00 ............ plus 6% of the amount over............$ 7,000

MARRIED FILING JOINT OR HEAD OF HOUSEHOLD

If Georgia taxable income is

Amount of Tax is

Not Over $ 1,000 ..............................................

1% of Taxable Income

Over

$ 1,000 ............ But not over ........... $ 3,000

$ 10.00 ............. plus 2% of the amount over........... $ 1,000

Over

$ 3,000 ............ But not over ........... $ 5,000

$ 50.00 ............. plus 3% of the amount over........... $ 3,000

Over

$ 5,000 ............ But not over ........... $ 7,000

$ 110.00 ............. plus 4% of the amount over........... $ 5,000

Over

$ 7,000 ............ But not over ........... $ 10,000

$ 190.00 ............. plus 5% of the amount over........... $ 7,000

Over

$10,000 ..............................................

$ 340.00 ............. plus 6% of the amount over........... $10,000

MARRIED FILING SEPARATE

If Georgia taxable income is

Amount of Tax is

Not Over $

500 ...............................................

1% of Taxable Income

Over

$

500 ............ But not over...........$1,500

$

5.00 ............. plus 2% of the amount over........... $

500

Over

$ 1,500 ............ But not over...........$2,500

$ 25.00 ............. plus 3% of the amount over........... $ 1,500

Over

$ 2,500 ............ But not over...........$3,500

$ 55.00 ............. plus 4% of the amount over........... $ 2,500

.........$

Over

$ 3,500 ............ But not over...........$5,000

$ 95.00 ............. plus 5% of the amount over

3,500

Over

$ 5,000 ..............................................

$ 170.00 ............. plus 6% of the amount over........... $ 5,000

Page 24

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32