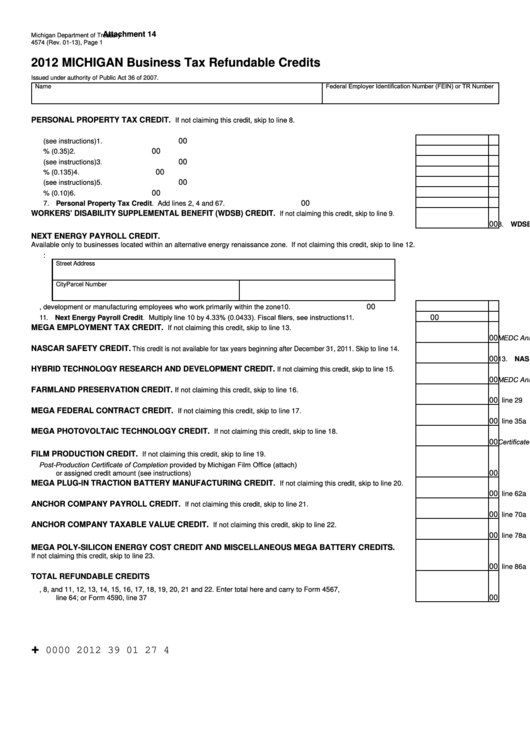

Form 4574 - Michigan Business Tax Refundable Credits - 2012

ADVERTISEMENT

Attachment 14

Michigan Department of Treasury

4574 (Rev. 01-13), Page 1

2012 MICHIGAN Business Tax Refundable Credits

Issued under authority of Public Act 36 of 2007.

Federal Employer Identification Number (FEIN) or TR Number

Name

PERSONAL PROPERTY TAX CREDIT.

If not claiming this credit, skip to line 8.

00

1. Property taxes paid on eligible industrial personal property in the current MBT tax year (see instructions) ..........

1.

00

2. Multiply line 1 by 35% (0.35) ..................................................................................................................................

2.

00

3. Property taxes paid on eligible telephone personal property in the current MBT tax year (see instructions) ..........

3.

00

4. Multiply line 3 by 13.5% (0.135) .............................................................................................................................

4.

00

5. Property taxes paid on eligible natural gas pipeline property in the current MBT tax year (see instructions) ........

5.

00

6. Multiply line 5 by 10% (0.10) ..................................................................................................................................

6.

00

7. Personal Property Tax Credit. Add lines 2, 4 and 6 ............................................................................................

7.

WORKERS’ DISABILITY SUPPLEMENTAL BENEFIT (WDSB) CREDIT.

If not claiming this credit, skip to line 9.

00

8. WDSB Credit allowed by the Workers’ Compensation Agency .............................................................................

8.

NEXT ENERGY PAYROLL CREDIT.

Available only to businesses located within an alternative energy renaissance zone. If not claiming this credit, skip to line 12.

9. Enter alternative energy renaissance zone property information below:

Street Address

City

Parcel Number

00

10. Total payroll of research, development or manufacturing employees who work primarily within the zone ............

10.

11. Next Energy Payroll Credit. Multiply line 10 by 4.33% (0.0433). Fiscal filers, see instructions ..........................

00

11.

MEGA EMPLOYMENT TAX CREDIT.

If not claiming this credit, skip to line 13.

12. Credit amount from MEDC Annual Tax Credit Certificate (attach) .........................................................................

00

12.

NASCAR SAFETY CREDIT.

This credit is not available for tax years beginning after December 31, 2011. Skip to line 14.

00

13. NASCAR Safety Credit. ........................................................................................................................................

13.

HYBRID TECHNOLOGY RESEARCH AND DEVELOPMENT CREDIT.

If not claiming this credit, skip to line 15.

14. Credit amount from MEDC Annual Tax Credit Certificate (attach). Cannot exceed $2,000,000 ............................

00

14.

FARMLAND PRESERVATION CREDIT.

If not claiming this credit, skip to line 16.

00

15. Credit amount from Form 4594, line 29 ..................................................................................................................

15.

MEGA FEDERAL CONTRACT CREDIT.

If not claiming this credit, skip to line 17.

00

16. Credit amount from Form 4584, line 35a ................................................................................................................

16.

MEGA PHOTOVOLTAIC TECHNOLOGY CREDIT.

If not claiming this credit, skip to line 18.

17. Credit amount from Certificate provided by MEDC (attach) or assigned credit amount .........................................

00

17.

FILM PRODUCTION CREDIT.

If not claiming this credit, skip to line 19.

18. Credit amount from Post-Production Certificate of Completion provided by Michigan Film Office (attach)

00

or assigned credit amount (see instructions) ..........................................................................................................

18.

MEGA PLUG-IN TRACTION BATTERY MANUFACTURING CREDIT.

If not claiming this credit, skip to line 20.

00

19. Credit amount from Form 4584, line 62a ................................................................................................................

19.

ANCHOR COMPANY PAYROLL CREDIT.

If not claiming this credit, skip to line 21.

00

20. Credit amount from Form 4584, line 70a ................................................................................................................

20.

ANCHOR COMPANY TAXABLE VALUE CREDIT.

If not claiming this credit, skip to line 22.

00

21. Credit amount from Form 4584, line 78a ...............................................................................................................

21.

MEGA POLY-SILICON ENERGY COST CREDIT AND MISCELLANEOUS MEGA BATTERY CREDITS.

If not claiming this credit, skip to line 23.

00

22. Credit amount from Form 4584, line 86a ................................................................................................................

22.

TOTAL REFUNDABLE CREDITS

23. Add lines 7, 8, and 11, 12, 13, 14, 15, 16, 17, 18, 19, 20, 21 and 22. Enter total here and carry to Form 4567,

00

line 64; or Form 4590, line 37 .................................................................................................................................

23.

+

0000 2012 39 01 27 4

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6