When the due date falls on a Saturday, Sunday, or legal holiday,

substitute the next regular workday.

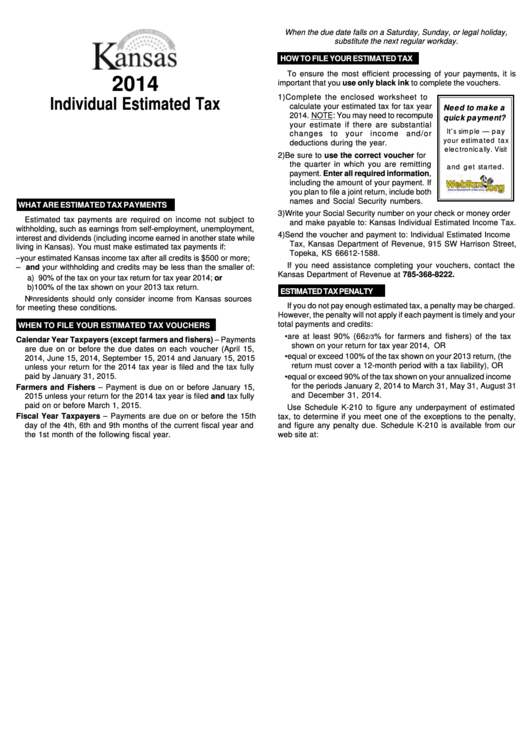

HOW TO FILE YOUR ESTIMATED TAX

To ensure the most efficient processing of your payments, it is

2014

important that you use only black ink to complete the vouchers.

1) Complete the enclosed worksheet to

Individual Estimated Tax

calculate your estimated tax for tax year

Need to make a

2014. NOTE: You may need to recompute

quick payment?

your estimate if there are substantial

It’s simple — pay

changes to your income and/or

your estimated tax

deductions during the year.

electronically. Visit

2) Be sure to use the correct voucher for

the quarter in which you are remitting

and get started.

payment. Enter all required information,

including the amount of your payment. If

you plan to file a joint return, include both

names and Social Security numbers.

WHAT ARE ESTIMATED TAX PAYMENTS

3) Write your Social Security number on your check or money order

Estimated tax payments are required on income not subject to

and make payable to: Kansas Individual Estimated Income Tax.

withholding, such as earnings from self-employment, unemployment,

4) Send the voucher and payment to: Individual Estimated Income

interest and dividends (including income earned in another state while

Tax, Kansas Department of Revenue, 915 SW Harrison Street,

living in Kansas). You must make estimated tax payments if:

Topeka, KS 66612-1588.

– your estimated Kansas income tax after all credits is $500 or more;

If you need assistance completing your vouchers, contact the

– and your withholding and credits may be less than the smaller of:

Kansas Department of Revenue at 785-368-8222.

a) 90% of the tax on your tax return for tax year 2014; or

b) 100% of the tax shown on your 2013 tax return.

ESTIMATED TAX PENALTY

Nonresidents should only consider income from Kansas sources

If you do not pay enough estimated tax, a penalty may be charged.

for meeting these conditions.

However, the penalty will not apply if each payment is timely and your

total payments and credits:

WHEN TO FILE YOUR ESTIMATED TAX VOUCHERS

• are at least 90% (66

% for farmers and fishers) of the tax

2/3

Calendar Year Taxpayers (except farmers and fishers) – Payments

shown on your return for tax year 2014, OR

are due on or before the due dates on each voucher (April 15,

• equal or exceed 100% of the tax shown on your 2013 return, (the

2014, June 15, 2014, September 15, 2014 and January 15, 2015

return must cover a 12-month period with a tax liability), OR

unless your return for the 2014 tax year is filed and the tax fully

paid by January 31, 2015.

• equal or exceed 90% of the tax shown on your annualized income

for the periods January 2, 2014 to March 31, May 31, August 31

Farmers and Fishers – Payment is due on or before January 15,

and December 31, 2014.

2015 unless your return for the 2014 tax year is filed and tax fully

paid on or before March 1, 2015.

Use Schedule K-210 to figure any underpayment of estimated

Fiscal Year Taxpayers – Payments are due on or before the 15th

tax, to determine if you meet one of the exceptions to the penalty,

day of the 4th, 6th and 9th months of the current fiscal year and

and figure any penalty due. Schedule K-210 is available from our

the 1st month of the following fiscal year.

web site at:

1

1 2

2 3

3 4

4 5

5 6

6