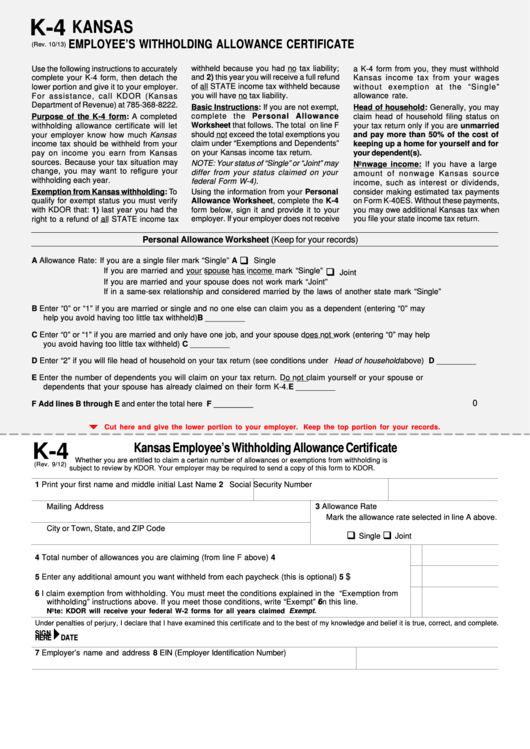

K-4

KANSAS

EMPLOYEE’S WITHHOLDING ALLOWANCE CERTIFICATE

(Rev. 10/13)

withheld because you had no tax liability;

a K-4 form from you, they must withhold

Use the following instructions to accurately

and 2) this year you will receive a full refund

complete your K-4 form, then detach the

Kansas income tax from your wages

of all STATE income tax withheld because

lower portion and give it to your employer.

without exemption at the “Single”

For assistance, call KDOR (Kansas

you will have no tax liability.

allowance rate.

Department of Revenue) at 785-368-8222.

Basic Instructions: If you are not exempt,

Head of household: Generally, you may

complete the Personal Allowance

claim head of household filing status on

Purpose of the K-4 form: A completed

Worksheet that follows. The total on line F

withholding allowance certificate will let

your tax return only if you are unmarried

should not exceed the total exemptions you

your employer know how much Kansas

and pay more than 50% of the cost of

income tax should be withheld from your

claim under “Exemptions and Dependents”

keeping up a home for yourself and for

on your Kansas income tax return.

your dependent(s).

pay on income you earn from Kansas

sources. Because your tax situation may

NOTE: Your status of “Single” or “Joint” may

Nonwage income: If you have a large

change, you may want to refigure your

differ from your status claimed on your

amount of nonwage Kansas source

withholding each year.

federal Form W-4).

income, such as interest or dividends,

Using the information from your Personal

consider making estimated tax payments

Exemption from Kansas withholding: To

qualify for exempt status you must verify

Allowance Worksheet, complete the K-4

on Form K-40ES. Without these payments,

with KDOR that: 1) last year you had the

form below, sign it and provide it to your

you may owe additional Kansas tax when

right to a refund of all STATE income tax

employer. If your employer does not receive

you file your state income tax return.

Personal Allowance Worksheet (Keep for your records)

‰

A Allowance Rate: If you are a single filer mark “Single”

A

Single

‰

If you are married and your spouse has income mark “Single”

Joint

If you are married and your spouse does not work mark “Joint”

If in a same-sex relationship and considered married by the laws of another state mark “Single”

B Enter “0” or “1” if you are married or single and no one else can claim you as a dependent (entering “0” may

help you avoid having too little tax withheld) ............................................................................................................... B _________

C Enter “0” or “1” if you are married and only have one job, and your spouse does not work (entering “0” may help

you avoid having too little tax withheld) ....................................................................................................................... C _________

D Enter “2” if you will file head of household on your tax return (see conditions under Head of household above) ..... D _________

E Enter the number of dependents you will claim on your tax return. Do not claim yourself or your spouse or

dependents that your spouse has already claimed on their form K-4. ..................................................................... E _________

0

F Add lines B through E and enter the total here .......................................................................................................... F _________

b

Cut here and give the lower portion to your employer. Keep the top portion for your records.

Kansas Employee’s Withholding Allowance Certificate

K-4

Whether you are entitled to claim a certain number of allowances or exemptions from withholding is

(Rev. 9/12)

subject to review by KDOR. Your employer may be required to send a copy of this form to KDOR.

1 Print your first name and middle initial

Last Name

2 Social Security Number

Mailing Address

3 Allowance Rate

Mark the allowance rate selected in line A above.

City or Town, State, and ZIP Code

‰

‰

Single

Joint

4 Total number of allowances you are claiming (from line F above) ...........................................................

4

$

5 Enter any additional amount you want withheld from each paycheck (this is optional) ...........................

5

6 I claim exemption from withholding. You must meet the conditions explained in the “Exemption from

withholding” instructions above. If you meet those conditions, write “Exempt” on this line. ....................

6

Note: KDOR will receive your federal W-2 forms for all years claimed Exempt .

Under penalties of perjury, I declare that I have examined this certificate and to the best of my knowledge and belief it is true, correct, and complete.

`

SIGN

HERE

DATE

7 Employer’s name and address

8 EIN (Employer Identification Number)

1

1