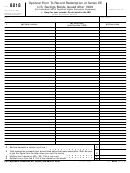

4

Form 8815 (2013)

Page

Line 9

Follow these steps before you fill in the Line 9 Worksheet below.

Line 9 Worksheet (keep a copy for your records)

Step

Action

1. Enter the amount from line 2 of Schedule B (Form

If you received social security benefits, use Pub. 915 to figure the

1

1040A or 1040)

.

.

.

.

.

.

.

.

.

1.

taxable amount of your benefits.

2. Form 1040 filers, add the amounts on lines 7, 9a, 10

2

If you made contributions to a traditional IRA for 2013 and you

through 14, 15b, 16b, 17 through 19, 20b, and 21.

were covered by a retirement plan at work or through self-

Enter the total. Form 1040A filers, add the amounts on

employment, use Pub. 590 to figure your IRA deduction.

lines 7, 9a, 10, 11b, 12b, 13, and 14b. Enter the total

2.

3. Add lines 1 and 2

.

.

.

.

.

.

.

.

3.

If you file Form 1040, figure any amount to be entered on the

3

dotted line next to line 36.

4. Form 1040 filers, enter the total of the amounts from

lines 23 through 32, plus any amount entered on the

4

Complete the following lines on your return if they apply.

dotted line next to line 36. Form 1040A filers, enter

the amount from lines 16 and 17 .

.

.

.

.

4.

IF you file Form...

THEN complete lines...

5. Subtract line 4 from line 3. Enter the result here and on

1040

8b, 9a–21, 23*–32

Form 8815, line 9 .

.

.

.

.

.

.

.

.

5.

1040A

8b, 9a–14b, 16*, and 17

If any of the following apply, see Pub. 550:

5

• You are filing Form 2555 or 2555-EZ (relating to foreign earned

income), or Form 4563 (exclusion of income for residents of

American Samoa),

• You have employer-provided adoption benefits for 2013,

• You are excluding income from Puerto Rico, or

• You have investment interest expense attributable to royalty

income.

*For purposes of figuring the amount to report on Form 8815, line 9, do

not reduce your educator expenses, if any, by the amount on Form

8815, line 14.

1

1 2

2 3

3 4

4