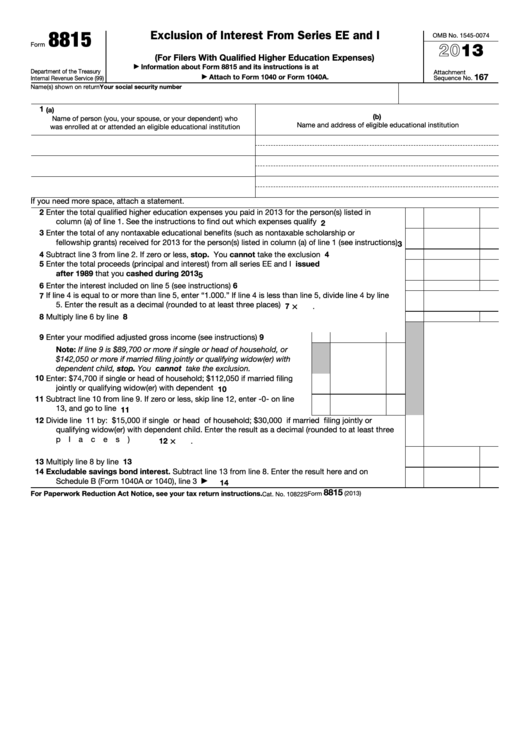

8815

Exclusion of Interest From Series EE and I

OMB No. 1545-0074

U.S. Savings Bonds Issued After 1989

2013

Form

(For Filers With Qualified Higher Education Expenses)

Information about Form 8815 and its instructions is at

▶

Department of the Treasury

Attachment

167

Attach to Form 1040 or Form 1040A.

Internal Revenue Service (99)

▶

Sequence No.

Name(s) shown on return

Your social security number

1

(a)

(b)

Name of person (you, your spouse, or your dependent) who

Name and address of eligible educational institution

was enrolled at or attended an eligible educational institution

If you need more space, attach a statement.

2

Enter the total qualified higher education expenses you paid in 2013 for the person(s) listed in

column (a) of line 1. See the instructions to find out which expenses qualify .

.

.

.

.

.

.

.

2

3

Enter the total of any nontaxable educational benefits (such as nontaxable scholarship or

fellowship grants) received for 2013 for the person(s) listed in column (a) of line 1 (see instructions)

3

4

Subtract line 3 from line 2. If zero or less, stop. You cannot take the exclusion

4

.

.

.

.

.

.

5

Enter the total proceeds (principal and interest) from all series EE and I U.S. savings bonds issued

after 1989 that you cashed during 2013

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

5

6

6

Enter the interest included on line 5 (see instructions)

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

If line 4 is equal to or more than line 5, enter “1.000.” If line 4 is less than line 5, divide line 4 by line

7

×

5. Enter the result as a decimal (rounded to at least three places)

.

.

.

.

.

.

.

.

.

.

.

7

.

8

Multiply line 6 by line 7

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

8

9

Enter your modified adjusted gross income (see instructions) .

.

.

.

9

Note: If line 9 is $89,700 or more if single or head of household, or

$142,050 or more if married filing jointly or qualifying widow(er) with

dependent child, stop. You cannot take the exclusion.

10

Enter: $74,700 if single or head of household; $112,050 if married filing

jointly or qualifying widow(er) with dependent child .

.

.

.

.

.

.

10

11

Subtract line 10 from line 9. If zero or less, skip line 12, enter -0- on line

13, and go to line 14 .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

11

12

Divide line 11 by: $15,000 if single or head of household; $30,000 if married filing jointly or

qualifying widow(er) with dependent child. Enter the result as a decimal (rounded to at least three

×

places) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

12

.

13

13

Multiply line 8 by line 12 .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

14

Excludable savings bond interest. Subtract line 13 from line 8. Enter the result here and on

Schedule B (Form 1040A or 1040), line 3

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

▶

14

8815

For Paperwork Reduction Act Notice, see your tax return instructions.

Form

(2013)

Cat. No. 10822S

1

1 2

2 3

3 4

4