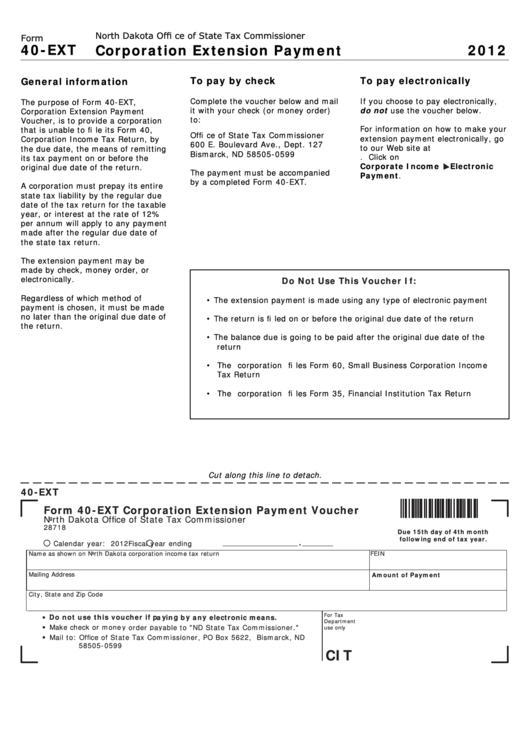

North Dakota Offi ce of State Tax Commissioner

Form

40-EXT

Corporation Extension Payment

2012

To pay by check

To pay electronically

General information

Complete the voucher below and mail

If you choose to pay electronically,

The purpose of Form 40-EXT,

it with your check (or money order)

do not use the voucher below.

Corporation Extension Payment

to:

Voucher, is to provide a corporation

For information on how to make your

that is unable to fi le its Form 40,

Offi ce of State Tax Commissioner

extension payment electronically, go

Corporation Income Tax Return, by

600 E. Boulevard Ave., Dept. 127

to our Web site at

the due date, the means of remitting

Bismarck, ND 58505-0599

Click on

its tax payment on or before the

Corporate Income

Electronic

original due date of the return.

The payment must be accompanied

Payment.

by a completed Form 40-EXT.

A corporation must prepay its entire

state tax liability by the regular due

date of the tax return for the taxable

year, or interest at the rate of 12%

per annum will apply to any payment

made after the regular due date of

the state tax return.

The extension payment may be

made by check, money order, or

electronically.

Do Not Use This Voucher If:

Regardless of which method of

• The extension payment is made using any type of electronic payment

payment is chosen, it must be made

no later than the original due date of

• The return is fi led on or before the original due date of the return

the return.

• The balance due is going to be paid after the original due date of the

return

• The corporation fi les Form 60, Small Business Corporation Income

Tax Return

• The corporation fi les Form 35, Financial Institution Tax Return

Cut along this line to detach.

40-EXT

Form 40-EXT Corporation Extension Payment Voucher

North Dakota Office of State Tax Commissioner

28718

Due 15th day of 4th month

following end of tax year.

Calendar year: 2012

Fiscal year ending

,

Name as shown on North Dakota corporation income tax return

FEIN

Mailing Address

Amount of Payment

City, State and Zip Code

For Tax

Do not use this voucher if paying by any electronic means.

•

Department

Make check or money order payable to "ND State Tax Commissioner."

•

use only

Mail to: Office of State Tax Commissioner, PO Box 5622, Bismarck, ND

•

58505-0599

CIT

1

1