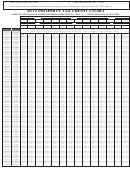

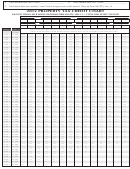

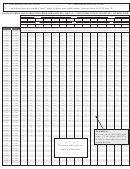

Form Mo-Pts - Property Tax Credit Chart - 2012 Page 3

ADVERTISEMENT

A.

Enter amount from Line 10 here _____________________

B.

Enter amount from Line 13 here ____________________

C.

Find where these two numbers “meet” below to figure your credit amount. Enter on Form MO-PTS, Line 14.

AMOUNT FROM LINE B ABOVE OR FROM FORM MO-PTS, LINE 13 — TOTAL REAL ESTATE TAX OR 20% OF RENT PAID

FROM

FROM

FROM

376

351

326

301

276

251

226

201

176

151

126

101

76

51

26

1

TO

TO

TO

400

375

350

325

300

275

250

225

200

175

150

125

100

75

50

25

FROM

TO

Refund is the actual total amount of allowable real estate tax paid, not to exceed $1,100 or rent credit equivalent not to exceed $750

(Form MO-PTS, Line 13). NOTE: If you rent from a facility that does not pay property taxes, you are not eligible for a Property Tax Credit.

1

14,300

14,301

14,600

378

353

328

303

278

253

228

203

178

153

128

103

78

53

28

3

14,601

14,900

369

344

319

294

269

244

219

194

169

144

119

94

69

44

19

14,901

15,200

359

334

309

284

259

234

209

184

159

134

109

84

59

34

9

15,201

15,500

349

324

299

274

249

224

199

174

149

124

99

74

49

24

15,501

15,800

339

314

289

264

239

214

189

164

139

114

89

64

39

14

15,801

16,100

328

303

278

253

228

203

178

153

128

103

78

53

28

3

16,101

16,400

316

291

266

241

216

191

166

141

116

91

66

41

16

16,401

16,700

305

280

255

230

205

180

155

130

105

80

55

30

5

16,701

17,000

293

268

243

218

193

168

143

118

93

68

43

18

17,001

17,300

280

255

230

205

180

155

130

105

80

55

30

5

17,301

17,600

268

243

218

193

168

143

118

93

68

43

18

17,601

17,900

254

229

204

179

154

129

104

79

54

29

4

17,901

18,200

241

216

191

166

141

116

91

66

41

16

18,201

18,500

227

202

177

152

127

102

77

52

27

2

18,501

18,800

213

188

163

138

113

88

63

38

13

18,801

19,100

198

173

148

123

98

73

48

23

19,101

19,400

183

158

133

108

83

58

33

8

19,401

19,700

168

143

118

93

68

43

18

19,701

20,000

152

127

102

77

52

27

2

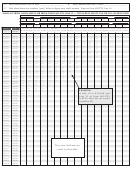

20,001

20,300

136

111

86

61

36

11

20,301

20,600

119

94

69

44

19

20,601

20,900

102

77

52

27

2

20,901

21,200

85

60

35

10

EXAMPLE:

21,201

21,500

67

42

17

If Line 10 is $19,360 and

21,501

21,800

49

24

Line 13 of Form MO-PTS

21,801

22,100

31

6

22,101

22,400

12

is $225, then the tax credit

22,401

22,700

would be $8.

22,701

23,000

23,001

23,300

23,301

23,600

23,601

23,900

23,901

24,200

24,201

24,500

24,501

24,800

24,801

25,100

25,101

25,400

25,401

25,700

25,701

26,000

26,001

26,300

26,301

26,600

26,601

26,900

26,901

27,200

27,201

27,500

27,501

27,800

This area indicates no

27,801

28,100

28,101

28,400

credit is allowable.

28,401

28,700

28,701

29,000

29,001

29,300

29,301

29,600

29,601

29,900

29,901

30,000

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3