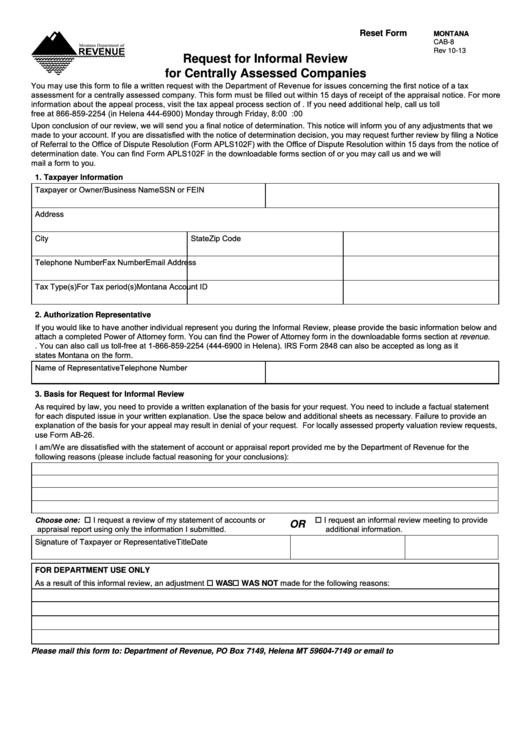

Reset Form

MONTANA

CAB-8

Rev 10-13

Request for Informal Review

for Centrally Assessed Companies

You may use this form to file a written request with the Department of Revenue for issues concerning the first notice of a tax

assessment for a centrally assessed company. This form must be filled out within 15 days of receipt of the appraisal notice. For more

information about the appeal process, visit the tax appeal process section of revenue.mt.gov. If you need additional help, call us toll

free at 866-859-2254 (in Helena 444-6900) Monday through Friday, 8:00 a.m. to 5:00 p.m.

Upon conclusion of our review, we will send you a final notice of determination. This notice will inform you of any adjustments that we

made to your account. If you are dissatisfied with the notice of determination decision, you may request further review by filing a Notice

of Referral to the Office of Dispute Resolution (Form APLS102F) with the Office of Dispute Resolution within 15 days from the notice of

determination date. You can find Form APLS102F in the downloadable forms section of revenue.mt.gov or you may call us and we will

mail a form to you.

1. Taxpayer Information

Taxpayer or Owner/Business Name

SSN or FEIN

Address

State

Zip Code

City

Telephone Number

Fax Number

Email Address

Tax Type(s)

For Tax period(s)

Montana Account ID

2. Authorization Representative

If you would like to have another individual represent you during the Informal Review, please provide the basic information below and

attach a completed Power of Attorney form. You can find the Power of Attorney form in the downloadable forms section at revenue.

mt.gov. You can also call us toll-free at 1-866-859-2254 (444-6900 in Helena). IRS Form 2848 can also be accepted as long as it

states Montana on the form.

Name of Representative

Telephone Number

3. Basis for Request for Informal Review

As required by law, you need to provide a written explanation of the basis for your request. You need to include a factual statement

for each disputed issue in your written explanation. Use the space below and additional sheets as necessary. Failure to provide an

explanation of the basis for your appeal may result in denial of your request. For locally assessed property valuation review requests,

use Form AB-26.

I am/We are dissatisfied with the statement of account or appraisal report provided me by the Department of Revenue for the

following reasons (please include factual reasoning for your conclusions):

I request a review of my statement of accounts or

I request an informal review meeting to provide

Choose one:

OR

appraisal report using only the information I submitted.

additional information.

Signature of Taxpayer or Representative

Title

Date

FOR DEPARTMENT USE ONLY

As a result of this informal review, an adjustment

made for the following reasons:

WAS

WAS NOT

Please mail this form to: Department of Revenue, PO Box 7149, Helena MT 59604-7149 or email to soaobjections@mt.gov.

1

1