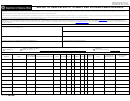

607, page 3

PERSONAL PROPERTY

NEW - Assessment increases because of added true cash value not accounted for on form 602

(formerly L-4018-P), including:

1. First time on roll. (For example: a new commercial tenant.)

2. Additional equipment or furnishings. (For example: a business acquired additional equipment so the total true cash

value of the equipment and furnishings increased from $50,000 to $80,000. The assessment therefore was raised

from $25,000 last year to $40,000 and the $15,000 increase is NEW.)

3. Change in law, reducing exemptions (Inventory, termination of Public Act 198 of 1974 certificate, etc.).

LOSS - Assessment decreases because of loss of true cash value not accounted for on form 602 (formerly L-4018-P),

including:

1. Removal from roll. (Out of business, etc.).

2. Fire losses or other damage. (Note: Tax day is December 31).

3. Decrease in true cash value of equipment, pipe lines, furnishings, equipment, etc.

4. Change in law, increasing exemptions (Inventory, air, water or Public Act 198 or 1974 certificate, etc.).

All changes in the assessment roll OTHER than those caused by changes in true cash value which qualify as NEW

or LOSS, including:

ADJUSTMENTS - Individual assessments raised or lowered to establish uniformity.

IMPORTANT NOTICE

Please be advised that L-4022’s are used in the equalization process in exactly the same way as they have been in

the past, before the passage of Proposal A on March 15, 1994. In other words, Capped and Taxable Values play no

part in the determination of County or State Equalized Valuations. DO NOT REPORT CAPPED OR TAXABLE

VALUES ON FORMS L-4022, L-4023 OR L-4024. STC FORM L-4022 MUST BE CERTIFIED BY THE

ASSESSOR BY SIGNING THE COMPLETED REPORT. UNSIGNED FORMS WILL BE

RETURNED TO THE ASSESSOR.

1

1 2

2 3

3