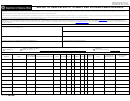

607, page 2

INSTRUCTIONS FOR FORM L-4022

P.A. 381, 1978 prescribes six real property and five personal property classifications.

REAL PROPERTY: Agricultural (Ag.), Commercial (C.), Industrial (Ind.), Residential (R.), Timber - Cutover T.C.)

and Developmental (D.). These Real Property classes are equalized separately.

PERSONAL PROPERTY: Agricultural (Ag. P.), Commercial (C.P.), Industrial (Ind. P.) Residential (R.P.) and Utilities

(Util. P.). All classes of Personal Property are equalized together as one class.

Each assessing officer must report total assessed value, assessed value of losses, assessed value of adjustments and new

assessed value for each class of property. All entries are to be the assessed values as approved by the Board of Review.

Form L-4021 and supporting form L-4022 shall be filed with the county equalization director for review and audit by the State

Tax Commission

REAL PROPERTY

NEW - Assessment increases because of added true cash value not accounted for in the starting ratio on form 603

(formerly L-4018-R), including:

1. Description on roll for first time or returned from exempt status.

2. Building or other improvement put on description.

3. New additions and improvements.

4. Further completion of new construction. (For example: partially complete building assessed at $2,500 last year;

assessment raised to $3,500 this year because completed; the $1,000 increase is NEW.)

5. Platted land. (For example: a 40 acre parcel was assessed last year for $10,000; the land has been platted

into 200 lots at $300 each or $60,000; the increased assessment would be NEW $50,000. If property had been

classified Agricultural, there would be $60,000 NEW in Residential and $10,000 LOSS in Agricultural.)

6. Increased land value or improved economic conditions. Note: Increases in assessments from one year to the next

due to inflationary increases in value are to be reported on form L-4022, if not included in the equalization study

report on form 603 (formerly L-4018-R).

(The New listed on Form L-4022 may not qualify for Additions on Form L-4025. See instructions on L-4025.)

Also, the amount of the NEW for equalization purposes for a particular item may not be the same as the amount of the

ADDITION for the cap for that same item. For example, an IFT NEW FACILITY whose exemption has expired comes

on the ad valorem roll at 50% of true cash value, but the ADDITION may be less than 50%.

LOSS - Assessment decreases because of loss of true cash value not accounted for on form 603 (formerly L-4018-R),

including:

1. Description removed from roll (annexation).

2. Building or other improvements destroyed or removed or exempt.

3. Part of a building removed or destroyed (Note: Tax day is December 31).

4. Losses from change of description (such as in item 5 under NEW).

5. Land reverted to state or otherwise exempt.

ADJUSTMENTS - All changes in the assessment roll OTHER than those caused by changes in true cash value which

qualify as NEW or LOSS, including:

1. Individual assessments raised or lowered to establish uniformity and meet the 50 percent requirement.

1

1 2

2 3

3