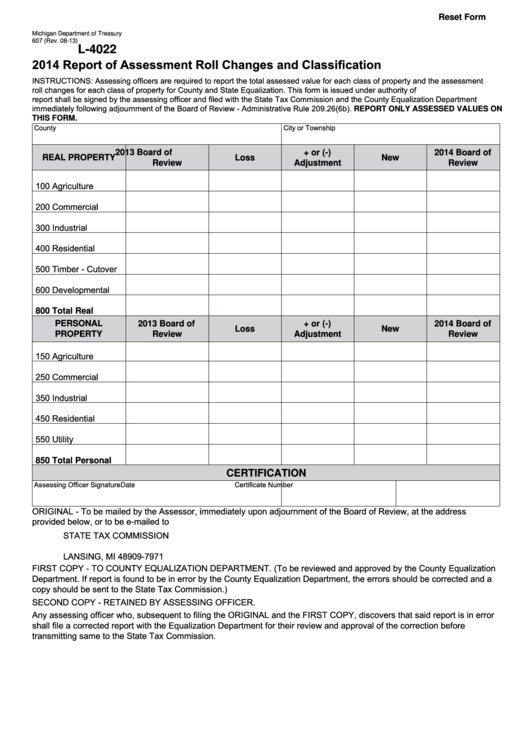

Reset Form

Michigan Department of Treasury

607 (Rev. 08-13)

L-4022

2014 Report of Assessment Roll Changes and Classification

INSTRUCTIONS: Assessing officers are required to report the total assessed value for each class of property and the assessment

roll changes for each class of property for County and State Equalization. This form is issued under authority of P.A. 206 of 1893. This

report shall be signed by the assessing officer and filed with the State Tax Commission and the County Equalization Department

immediately following adjournment of the Board of Review - Administrative Rule 209.26(6b). REPORT ONLY ASSESSED VALUES ON

THIS FORM.

City or Township

County

2013 Board of

+ or (-)

2014 Board of

REAL PROPERTY

Loss

New

Review

Adjustment

Review

100 Agriculture

200 Commercial

300 Industrial

400 Residential

500 Timber - Cutover

600 Developmental

800 Total Real

PERSONAL

2013 Board of

+ or (-)

2014 Board of

Loss

New

PROPERTY

Review

Adjustment

Review

150 Agriculture

250 Commercial

350 Industrial

450 Residential

550 Utility

850 Total Personal

CERTIFICATION

Assessing Officer Signature

Certificate Number

Date

ORIGINAL - To be mailed by the Assessor, immediately upon adjournment of the Board of Review, at the address

provided below, or to be e-mailed to ParrL@michigan.gov.

STATE TAX COMMISSION

P.O. BOX 30471

LANSING, MI 48909-7971

FIRST COPY - TO COUNTY EQUALIZATION DEPARTMENT. (To be reviewed and approved by the County Equalization

Department. If report is found to be in error by the County Equalization Department, the errors should be corrected and a

copy should be sent to the State Tax Commission.)

SECOND COPY - RETAINED BY ASSESSING OFFICER.

Any assessing officer who, subsequent to filing the ORIGINAL and the FIRST COPY, discovers that said report is in error

shall file a corrected report with the Equalization Department for their review and approval of the correction before

transmitting same to the State Tax Commission.

1

1 2

2 3

3