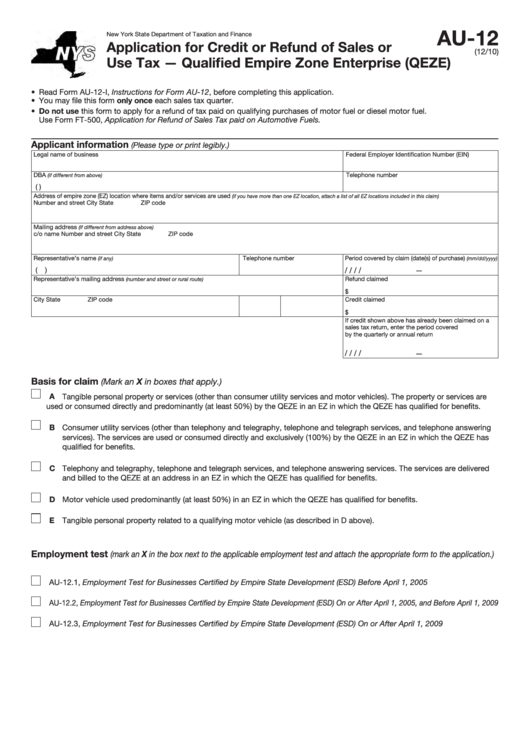

AU-12

New York State Department of Taxation and Finance

Application for Credit or Refund of Sales or

(12/10)

Use Tax — Qualified Empire Zone Enterprise (QEZE)

• Read Form AU-12-I, Instructions for Form AU-12, before completing this application.

• You may file this form only once each sales tax quarter.

• Do not use this form to apply for a refund of tax paid on qualifying purchases of motor fuel or diesel motor fuel.

Use Form FT-500, Application for Refund of Sales Tax paid on Automotive Fuels.

Applicant information

(Please type or print legibly.)

Legal name of business

Federal Employer Identification Number (EIN)

DBA

Telephone number

(if different from above)

(

)

Address of empire zone (EZ) location where items and/or services are used

(if you have more than one EZ location, attach a list of all EZ locations included in this claim)

Number and street

City

State

ZIP code

Mailing address

(if different from address above)

c/o name

Number and street

City

State

ZIP code

Representative’s name

Telephone number

Period covered by claim (date(s) of purchase)

(if any)

(mm/dd/yyyy)

(

)

—

/

/

/

/

Representative’s mailing address

Refund claimed

(number and street or rural route)

$

City

State

ZIP code

Credit claimed

$

If credit shown above has already been claimed on a

sales tax return, enter the period covered

by the quarterly or annual return

—

/

/

/

/

Basis for claim

(Mark an X in boxes that apply.)

A Tangible personal property or services (other than consumer utility services and motor vehicles). The property or services are

used or consumed directly and predominantly (at least 50%) by the QEZE in an EZ in which the QEZE has qualified for benefits.

B Consumer utility services (other than telephony and telegraphy, telephone and telegraph services, and telephone answering

services). The services are used or consumed directly and exclusively (100%) by the QEZE in an EZ in which the QEZE has

qualified for benefits.

C Telephony and telegraphy, telephone and telegraph services, and telephone answering services. The services are delivered

and billed to the QEZE at an address in an EZ in which the QEZE has qualified for benefits.

D Motor vehicle used predominantly (at least 50%) in an EZ in which the QEZE has qualified for benefits.

E Tangible personal property related to a qualifying motor vehicle (as described in D above).

Employment test

(mark an X in the box next to the applicable employment test and attach the appropriate form to the application.)

AU-12.1, Employment Test for Businesses Certified by Empire State Development (ESD) Before April 1, 2005

AU-12.2, Employment Test for Businesses Certified by Empire State Development (ESD) On or After April 1, 2005, and Before April 1, 2009

AU-12.3, Employment Test for Businesses Certified by Empire State Development (ESD) On or After April 1, 2009

1

1 2

2