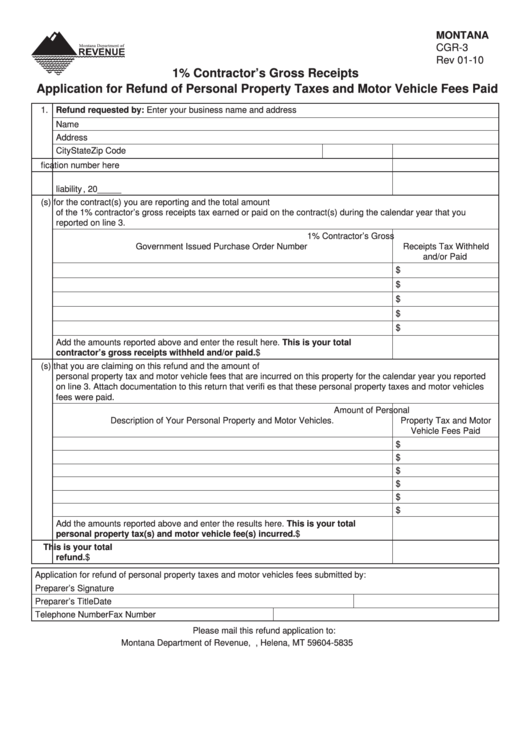

MONTANA

CGR-3

Rev 01-10

1% Contractor’s Gross Receipts

Application for Refund of Personal Property Taxes and Motor Vehicle Fees Paid

1. Refund requested by: Enter your business name and address

Name

Address

City

State

Zip Code

2. Enter your federal employer identifi cation number here ................................................2.

3. Enter the calendar year you incurred a personal property tax or motor vehicle fee

liability ........................................................................................................................... 3.

December 31, 20_____

4. Enter the Government Issued Purchase Order Number(s) for the contract(s) you are reporting and the total amount

of the 1% contractor’s gross receipts tax earned or paid on the contract(s) during the calendar year that you

reported on line 3.

1% Contractor’s Gross

Government Issued Purchase Order Number

Receipts Tax Withheld

and/or Paid

$

$

$

$

$

Add the amounts reported above and enter the result here. This is your total

contractor’s gross receipts withheld and/or paid. ...................................................4. $

5. Enter a description of your personal property and vehicle(s) that you are claiming on this refund and the amount of

personal property tax and motor vehicle fees that are incurred on this property for the calendar year you reported

on line 3. Attach documentation to this return that verifi es that these personal property taxes and motor vehicles

fees were paid.

Amount of Personal

Description of Your Personal Property and Motor Vehicles.

Property Tax and Motor

Vehicle Fees Paid

$

$

$

$

$

$

Add the amounts reported above and enter the results here. This is your total

personal property tax(s) and motor vehicle fee(s) incurred....................................5. $

6. Enter the smaller of the amounts reported on line 4 or line 5. This is your total

refund. ..........................................................................................................................6. $

Application for refund of personal property taxes and motor vehicles fees submitted by:

Preparer’s Signature

Preparer’s Title

Date

Telephone Number

Fax Number

Please mail this refund application to:

Montana Department of Revenue, P.O. Box 5835, Helena, MT 59604-5835

1

1