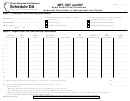

Schedule Da (Form Rmft-6-Df) - Mft, Ust, And Eif Dyed Diesel Fuel Produced, Acquired, Received, Or Transported Into Illinois Page 2

ADVERTISEMENT

General Instructions

Schedule DA is used for reporting the

What if I need additional assistance?

Column 7 - Write the name of the Illinois city to

following taxes:

which the dyed diesel fuel product was delivered.

If you have questions about this schedule, write to us

• Motor Fuel Tax (MFT)

at Motor Fuel Tax, Illinois Department of Revenue,

Column 8 - Write the seller’s Illinois license number.

• Underground Storage Tank Tax (UST)

P .O. Box 19477, Springfield, Illinois 62794-9477, or

• Environmental Impact Fee (EIF)

call our Springfield office weekdays between 8 a.m.

Column 9 - Write the number of invoiced gallons.

and 4:30 p.m. at 217 782-2291.

Line 11 - Add the invoiced gallons reported in

What is dyed diesel fuel?

Column 9, Lines 1 through 10.

Step-by-Step Instructions

Dyed diesel fuel is any special fuel that has been

dyed per Section 4d of the Motor Fuel Tax Law.

Line 12 - If you are filing more than one Sched-

ule DA, group together all Schedules DA that

Step 1: Complete the following

When do I file this schedule?

report

information

You must file Schedule DA with Form RMFT-5,

Write your company name, your license number,

• MFT-free only gallons. Add Lines 11 from this

Motor Fuel Distributor/Supplier Tax Return, if you

and the period for which you are reporting. Check

group, and write the total on Line 12 of the last

are reporting MFT-free gallons only or both MFT-

the boxes next to the tax/fee type and the receipt

page.

and UST-/EIF-free gallons. If you are a distributor

type you are listing on this page. Report one tax/fee

or supplier, you must report all dyed diesel fuel

• UST-/EIF-free only gallons. Add Lines 11 from

type and one receipt type only per page.

transactions as MFT-free.

this group, and write the total on Line 12 of the

last page.

Step 2: Report your tax- and fee-free

You must file Schedule DA with Form RMFT-5-US,

purchases

• both MFT- and UST-/EIF-free gallons. Add

Underground Storage Tank Tax and Environmental

Lines 11 from this group, and write the total on

Impact Fee Receiver Tax Return, if you are report-

Lines 1 through 10 —

Line 12 of the last page.

ing only UST-/EIF-free gallons.

Column 1 - Write the month, day, and year of the

invoice.

Then, add the totals from Lines 12 of the Sched-

What must I attach to this schedule?

ules DA that report

Column 2 - Write the invoice number.

You must attach the credit invoices issued by the

seller to Schedule DA. We will return your credit in-

• MFT-free gallons only group and the both

Column 3 - Write the carrier’s complete business

voices to you upon request.

MFT- and UST-/EIF-free gallons group and

name.

write this amount on Form RMFT-5, Line 2a,

What records must I keep?

Column 3.

Column 4 - Write the bill of lading or manifest

You are required by law to keep books and

number.

• UST-/EIF-free gallons only group and the both

records showing all purchases, receipts, losses

MFT- and UST-/EIF-free gallons group and

through any cause, sales, distributions, and use of

Column 5 - Write the seller’s complete name.

write this amount on Form RMFT-5-US, Line 2a,

fuels.

Column 1.

Column 6 - Write the city and the state (using the

two-character U.S. Post Office abbreviation) from

which the dyed diesel fuel product originated.

RMFT-6-DF back (N-12/99)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2