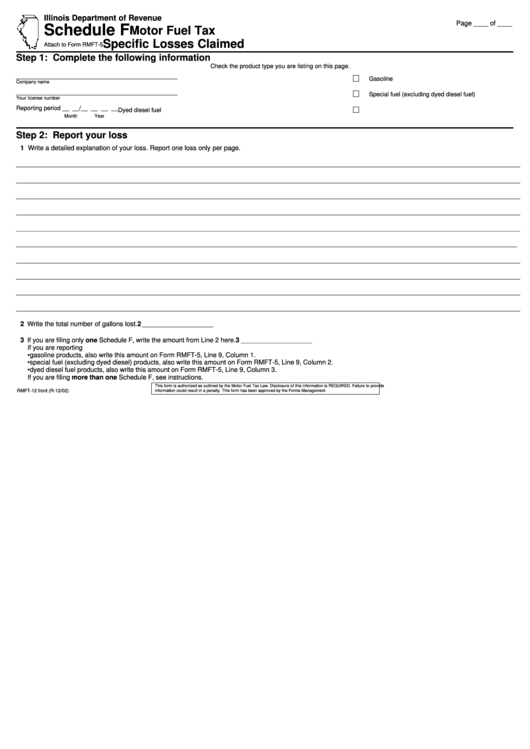

Schedule F (Form Rmft-12) - Motor Fuel Tax Specific Losses Claimed

ADVERTISEMENT

Illinois Department of Revenue

Page ____ of ____

Schedule F

Motor Fuel Tax

Specific Losses Claimed

Attach to Form RMFT-5

Step 1: Complete the following information

Check the product type you are listing on this page.

_______________________________________________

Gasoline

Company name

_______________________________________________

Special fuel (excluding dyed diesel fuel)

Your license number

Reporting period __ __/__ __ __ __

Dyed diesel fuel

Month

Year

Step 2: Report your loss

1 Write a detailed explanation of your loss. Report one loss only per page.

_____________________________________________________________________________________________________________________________________________________

_____________________________________________________________________________________________________________________________________________________

_____________________________________________________________________________________________________________________________________________________

_____________________________________________________________________________________________________________________________________________________

_____________________________________________________________________________________________________________________________________________________

____________________________________________________________________________________________________________________________________________________

_____________________________________________________________________________________________________________________________________________________

_____________________________________________________________________________________________________________________________________________________

_____________________________________________________________________________________________________________________________________________________

_____________________________________________________________________________________________________________________________________________________

2 Write the total number of gallons lost.

2

_____________________

3 If you are filing only one Schedule F, write the amount from Line 2 here.

3

_____________________

If you are reporting

• gasoline products, also write this amount on Form RMFT-5, Line 9, Column 1.

• special fuel (excluding dyed diesel) products, also write this amount on Form RMFT-5, Line 9, Column 2.

• dyed diesel fuel products, also write this amount on Form RMFT-5, Line 9, Column 3.

If you are filing more than one Schedule F, see instructions.

This form is authorized as outlined by the Motor Fuel Tax Law. Disclosure of this information is REQUIRED. Failure to provide

RMFT-12 front (R-12/02)

information could result in a penalty. This form has been approved by the Forms Management Center.

IL-492-0080

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2