Form 4259 - T-101 Schedule Of Other Tobacco Product Purchases (Receipts)

ADVERTISEMENT

Michigan Department of Treasury

4259 (Rev. 01-13)

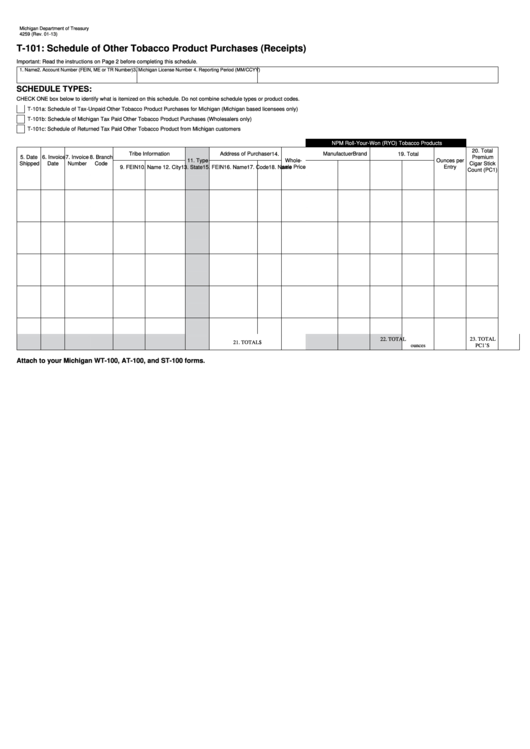

T-101: Schedule of Other Tobacco Product Purchases (Receipts)

Important: Read the instructions on Page 2 before completing this schedule.

1. Name

2. Account Number (FEIN, ME or TR Number)

3. Michigan License Number

4. Reporting Period (MM/CCYY)

SCHEDULE TYPES:

CHECK ONE box below to identify what is itemized on this schedule. Do not combine schedule types or product codes.

T-101a: Schedule of Tax-Unpaid Other Tobacco Product Purchases for Michigan (Michigan based licensees only)

T-101b: Schedule of Michigan Tax Paid Other Tobacco Product Purchases (Wholesalers only)

T-101c: Schedule of Returned Tax Paid Other Tobacco Product from Michigan customers

NPM Roll-Your-Won (RYO) Tobacco Products

20. Total

Tribe Information

Address of Purchaser

14.

Manufactuer

Brand

19. Total

5. Date

6. Invoice

7. Invoice

8. Branch

Premium

11. Type

Whole-

Ounces per

Shipped

Date

Number

Code

Cigar Stick

9. FEIN

10. Name

12. City

13. State

sale Price

15. FEIN

16. Name

17. Code

18. Name

Entry

Count (PC1)

22. TOTAL

23. TOTAL

21. TOTAL

$

ounces

PC1’S

Attach to your Michigan WT-100, AT-100, and ST-100 forms.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2