Form 200 - Virginia Litter Tax

of whether you operate on a calendar or fiscal year basis for tax

Who is Liable For the Virginia Litter Tax: The Virginia Litter Tax

purposes. When the return is filed, the full amount of the tax as shown

does not apply to individual consumers. The Litter Tax is imposed on

on the face of the return should be paid. The Code of Virginia does not

every “person” in the state who, on January 1 of the taxable year, was

provide for an extension of time to file Form 200 and pay the Litter Tax.

engaged in business as a manufacturer, wholesaler, distributor, or

retailer of certain enumerated products. The tax is imposed on:

Tax Rates: An annual $10 Litter Tax is imposed on each Virginia

• An individual as a sole proprietor

business establishment from which such a business is conducted on

January 1 of the taxable year.

• Partnerships, but not partners

In addition to the $10 Litter Tax, each business operating as a

• Limited liability companies, but not members

manufacturer, wholesaler, distributor or retailer of groceries, soft

• S Corporations, but not shareholders

drinks, carbonated waters, or beer or other malt beverages shall

• Corporations, but not shareholders

pay an additional annual Litter Tax of $15 for each Virginia business

• Associations, but not members

establishment from which such business is conducted.

Penalty and Interest: If your Litter Tax Return is not filed and full

• Trusts or estates operating such businesses

payment is not made by the due date, a penalty of 100% of the Litter

Any person who manufactures, wholesales, distributes, or retails any

Tax will apply. Interest will accrue at the underpayment rate established

of the following products is subject to the tax:

under Code of Virginia Section 58. 1-15 on the unpaid amount of tax

• Food for human or pet consumption

and penalty from the due date of the return until the time of payment.

• Groceries

When and Where To Pay: Pay the balance due as shown on this return

• Cigarettes and tobacco products

by midnight, May 1 regardless of whether you operate on a calendar

or fiscal year basis. No extension of time to file or pay is provided by

• Soft drinks and carbonated waters

law and no such extension will be granted even if an extension has

• Motor vehicle parts

been granted to file an income tax return.

• Distilled spirits, wine, beer and other malt beverages

If May 1 falls on a Saturday, Sunday or legal holiday you must file your

• Newspapers and magazines

return by midnight of the next succeeding day that is not a Saturday,

Sunday or legal holiday.

• Paper products and household paper

Mail Form 200 with your payment to:

• Metal and glass containers

Virginia Department of Taxation

• Plastic or fiber containers made of synthetic material

Litter Tax

• Cleaning agents and toiletries

P.O. Box 2185

• Non-drug drugstore sundry products

Richmond, Virginia 23218-2185

Please enter your account number on the check or money order and

Filing Procedure: If you are not in business on January 1, you are

make a notation that the check is for Litter Tax. Payments returned by

not liable for Virginia Litter Tax until the next succeeding calendar year.

the bank will be subject to a returned payment fee in addition to any

For example, if you open your business on February 1, 2002, and are

subject to the Litter Tax, you are not liable for Litter Tax until May 1,

other penalties that may be incurred.

2004 for the year 2003.

Where To Get Help: For assistance call (804) 367-8037 or write to

The Litter Tax Return, Form 200, must be filed with the Virginia

the Department of Taxation; ATTN: Customer Services; P.O. Box

Department of Taxation and the tax paid on or before May 1, regardless

1115; Richmond, VA 23218-1115.

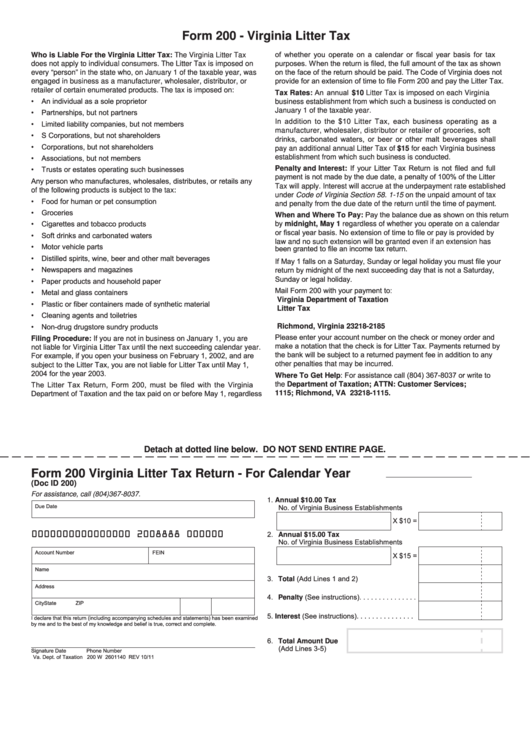

Detach at dotted line below. DO NOT SEND ENTIRE PAGE.

Form 200

Virginia Litter Tax Return - For Calendar Year

(Doc ID 200)

For assistance, call (804)367-8037.

1. Annual $10.00 Tax

Due Date

No. of Virginia Business Establishments

X $10 =

0000000000000000 2008888 000000

2. Annual $15.00 Tax

No. of Virginia Business Establishments

Account Number

FEIN

X $15 =

Name

3. Total (Add Lines 1 and 2) . . . . . . . . . . . . . . .

Address

4. Penalty (See instructions). . . . . . . . . . . . . . .

City

State

ZIP

5. Interest (See instructions). . . . . . . . . . . . . . .

I declare that this return (including accompanying schedules and statements) has been examined

by me and to the best of my knowledge and belief is true, correct and complete.

6. Total Amount Due

(Add Lines 3-5)

Signature

Date

Phone Number

Va. Dept. of Taxation 200 W 2601140 REV 10/11

1

1