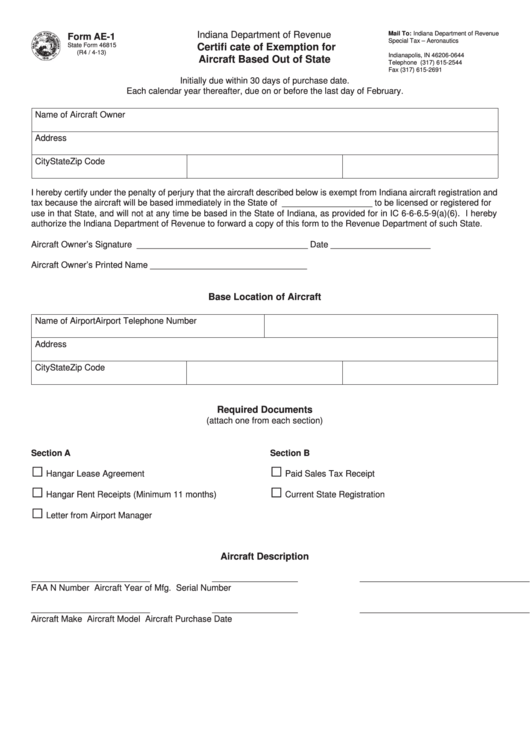

Indiana Department of Revenue

Mail To: Indiana Department of Revenue

Form AE-1

Special Tax – Aeronautics

State Form 46815

Certifi cate of Exemption for

P.O. Box 644

(R4 / 4-13)

Indianapolis, IN 46206-0644

Aircraft Based Out of State

Telephone (317) 615-2544

Fax (317) 615-2691

Initially due within 30 days of purchase date.

Each calendar year thereafter, due on or before the last day of February.

Name of Aircraft Owner

Address

City

State

Zip Code

I hereby certify under the penalty of perjury that the aircraft described below is exempt from Indiana aircraft registration and

tax because the aircraft will be based immediately in the State of ___________________ to be licensed or registered for

use in that State, and will not at any time be based in the State of Indiana, as provided for in IC 6-6-6.5-9(a)(6). I hereby

authorize the Indiana Department of Revenue to forward a copy of this form to the Revenue Department of such State.

Aircraft Owner’s Signature ____________________________________

Date _____________________

Aircraft Owner’s Printed Name _________________________________

Base Location of Aircraft

Name of Airport

Airport Telephone Number

Address

City

State

Zip Code

Required Documents

(attach one from each section)

Section A

Section B

□

□

Hangar Lease Agreement

Paid Sales Tax Receipt

□

□

Hangar Rent Receipts (Minimum 11 months)

Current State Registration

□

Letter from Airport Manager

Aircraft Description

_________________________

__________________

______________________________________

FAA N Number

Aircraft Year of Mfg.

Serial Number

_________________________

__________________

______________________________________

Aircraft Make

Aircraft Model

Aircraft Purchase Date

1

1