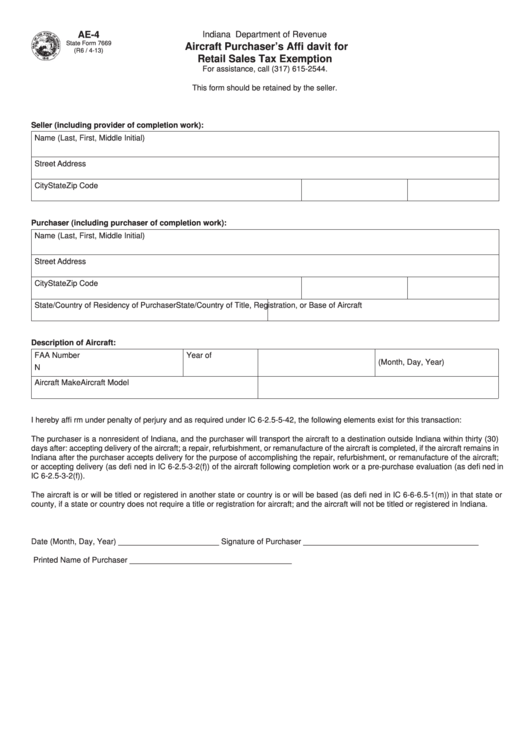

AE-4

Indiana Department of Revenue

State Form 7669

Aircraft Purchaser’s Affi davit for

(R6 / 4-13)

Retail Sales Tax Exemption

For assistance, call (317) 615-2544.

This form should be retained by the seller.

Seller (including provider of completion work):

Name (Last, First, Middle Initial)

Street Address

City

State

Zip Code

Purchaser (including purchaser of completion work):

Name (Last, First, Middle Initial)

Street Address

City

State

Zip Code

State/Country of Residency of Purchaser

State/Country of Title, Registration, or Base of Aircraft

Description of Aircraft:

FAA Number

Year of Mfg.

Serial Number

Date of Purchase

(Month, Day, Year)

N

Aircraft Make

Aircraft Model

I hereby affi rm under penalty of perjury and as required under IC 6-2.5-5-42, the following elements exist for this transaction:

The purchaser is a nonresident of Indiana, and the purchaser will transport the aircraft to a destination outside Indiana within thirty (30)

days after: accepting delivery of the aircraft; a repair, refurbishment, or remanufacture of the aircraft is completed, if the aircraft remains in

Indiana after the purchaser accepts delivery for the purpose of accomplishing the repair, refurbishment, or remanufacture of the aircraft;

or accepting delivery (as defi ned in IC 6-2.5-3-2(f)) of the aircraft following completion work or a pre-purchase evaluation (as defi ned in

IC 6-2.5-3-2(f)).

The aircraft is or will be titled or registered in another state or country is or will be based (as defi ned in IC 6-6-6.5-1(m)) in that state or

county, if a state or country does not require a title or registration for aircraft; and the aircraft will not be titled or registered in Indiana.

Date (Month, Day, Year) _______________________

Signature of Purchaser ________________________________________

Printed Name of Purchaser _____________________________________

1

1