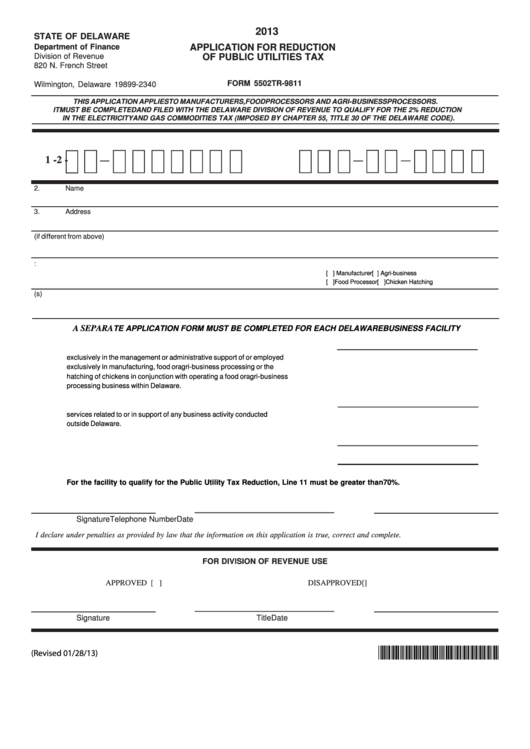

2013

STATE OF DELAWARE

Department of Finance

APPLICATION FOR REDUCTION

Division of Revenue

OF PUBLIC UTILITIES TAX

820 N. French Street

P.O. Box 2340

FORM 5502TR-9811

Wilmington, Delaware 19899-2340

THIS APPLICATION APPLIES TO MANUFACTURERS, FOOD PROCESSORS AND AGRI-BUSINESS PROCESSORS.

IT MUST BE COMPLETED AND FILED WITH THE DELAWARE DIVISION OF REVENUE TO QUALIFY FOR THE 2% REDUCTION

IN THE ELECTRICITY AND GAS COMMODITIES TAX (IMPOSED BY CHAPTER 55, TITLE 30 OF THE DELAWARE CODE).

1.

Enter Federal Employer Identification Number

OR

Social Security Number

1 -

2 -

2.

Name

3.

Address

4.

Location of Facility (if different from above)

5.

Division of Revenue Business License Number

6. Check One or More:

[ ] Manufacturer

[ ] Agri-business

[ ] Food Processor

[ ] Chicken Hatching

7.

Utility Name/Utility Account Number(s)

A SEPARA

TE APPLICATION FORM MUST BE COMPLETED FOR EACH DELAWARE BUSINESS FACILITY

8.

Enter the number of employees located at this facility who are engaged

exclusively in the management or administrative support of or employed

exclusively in manufacturing, food or agri-business processing or the

hatching of chickens in conjunction with operating a food or agri-business

processing business within Delaware.

9.

Enter the number of employees located at this facility who perform

services related to or in support of any business activity conducted

outside Delaware.

10.

Enter the total number of employees at this facility. Add Lines 8 and 9.

11.

Divide Line 8 by Line 10 and enter the percentage here.

For the facility to qualify for the Public Utility Tax Reduction, Line 11 must be greater than 70%.

Signature

Telephone Number

Date

I declare under penalties as provided by law that the information on this application is true, correct and complete.

FOR DIVISION OF REVENUE USE

APPROVED [ ]

DISAPPROVED [ ]

Signature

Title

Date

*DF40613019999*

(Revised 01/28/13)

1

1 2

2