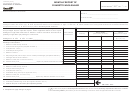

PART IV - MONTHLY REPORT OF NONPARTICIPATING MANUFACTURER

73A422 (8-13)

ROLL YOUR OWN TOBACCO SOLD IN KENTUCKY

Page 3

Distributor

City

License/Account Number

For Month/Year

INSTRUCTIONS: KRS 131.600(10), effective June 30, 2000, directs the Kentucky Department of Revenue to ascertain the number of units (individual cigarettes) sold in the state each year by

nonparticipating manufacturers (manufacturers and importers of cigarettes who did not sign the Master Settlement Agreement (MSA) entered into on November 23, 1998, with this state). Effective

April 25, 2006, roll your own tobacco is to be reported for MSA purposes.

List the nonparticipating manufacturer for each brand that was sold in Kentucky during the month on which the tobacco products tax was paid. If the roll your own tobacco was not purchased directly

from the manufacturer, that information may be obtained from the carton or packaging. If the roll your own tobacco was received from another wholesaler who has already paid the tobacco products

tax, do not list on this report. If you do not sell any roll your own tobacco during the month from a nonparticipating manufacturer, enter "NONE" in the boxes. All boxes shall be completed.

A copy of all invoices covering these shipments to you should be attached to this report.

Ounces of

Nonparticipating

Roll Your

Manufacturer Has a

Name and Address of Seller

Brand

Nonparticipating

Own

Qualified Escrow Account

From Whom Brand Was Purchased

Name

Manufacturer's Name and Address

Tobacco

(Indicate if Known )

(if Different from Original Manufacturer )

Sold

in Kentucky

No

Yes

IMPORTANT: I agree to allow the Kentucky Department of Revenue or the Attorney General to release, to the manufacturer, information which I have provided on part IV of Revenue Form

73A422, Monthly Report of Tobacco Products, Snuff, and Chewing Tobacco. I understand that this information might ultimately become part of an official court record if an

enforcement action is taken against that manufacturer.

1

1 2

2 3

3