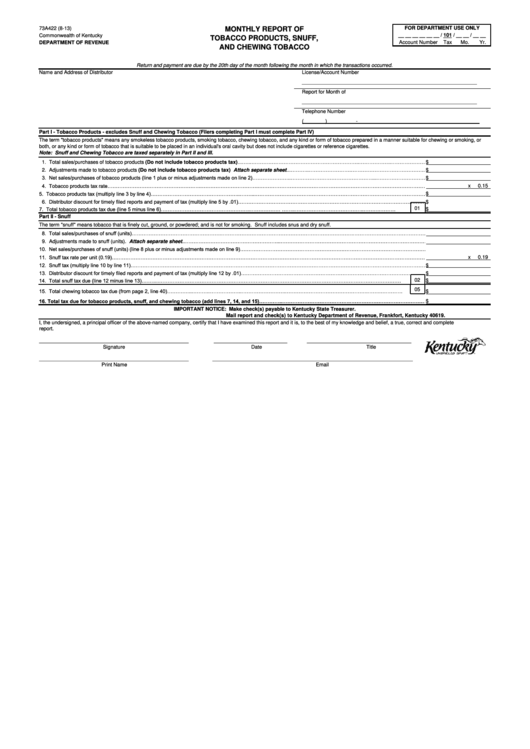

73A422 (8-13)

MONTHLY REPORT OF

FOR DEPARTMENT USE ONLY

Commonwealth of Kentucky

__ __ __ __ __ __ / 101 / __ __ / __ __

TOBACCO PRODUCTS, SNUFF,

DEPARTMENT OF REVENUE

Account Number

Tax

Mo.

Yr.

AND CHEWING TOBACCO

Return and payment are due by the 20th day of the month following the month in which the transactions occurred.

Name and Address of Distributor

License/Account Number

______________________________________________________________

Report for Month of

______________________________________________________________

Telephone Number

(

)

-

Part I - Tobacco Products - excludes Snuff and Chewing Tobacco (Filers completing Part I must complete Part IV)

The term "tobacco products" means any smokeless tobacco products, smoking tobacco, chewing tobacco, and any kind or form of tobacco prepared in a manner suitable for chewing or smoking, or

both, or any kind or form of tobacco that is suitable to be placed in an individual's oral cavity but does not include cigarettes or reference cigarettes.

Note: Snuff and Chewing Tobacco are taxed separately in Part II and III.

1. Total sales/purchases of tobacco products (Do not include tobacco products tax)...…..………………………………………………………..……………….…………………………………………………………………………

$

2. Adjustments made to tobacco products (Do not include tobacco products tax) Attach separate sheet ...………..…………………….…………………………………….…………………………………………………………

$

3. Net sales/purchases of tobacco products (line 1 plus or minus adjustments made on line 2)…………………..…………………………………………...…………………………………………………………………………………

$

4. Tobacco products tax rate……………………………………………….…………………………….………………………………………………………………………………………………………………………………………………

x

0.15

5. Tobacco products tax (multiply line 3 by line 4)……………………………………………..……...………………………………………………………………………………………………………………………………………………

$

6. Distributor discount for timely filed reports and payment of tax (multiply line 5 by .01)…………………………………………………………………………………………………………………………………………………………

$

7. Total tobacco products tax due (line 5 minus line 6)……………………………………………..………………....……..…………………………………..……….………

01

$

Part II - Snuff

The term "snuff" means tobacco that is finely cut, ground, or powdered; and is not for smoking. Snuff includes snus and dry snuff.

8. Total sales/purchases of snuff (units)…………………………………………….…………………………………………………………………….…………………………………………………………………………………….………

9. Adjustments made to snuff (units). Attach separate sheet ..………………………………………………...…………………………………………………………………………………………………………………………………

10. Net sales/purchases of snuff (units) (line 8 plus or minus adjustments made on line 9)…………………………………………………….…………………………………………………………………………………………………

11. Snuff tax rate per unit (0.19)…………………………………………………………………………………………………………………………………………………………………………………………….…………….………….……

x

0.19

12. Snuff tax (multiply line 10 by line 11)…………………………………………………………………………………………………………………………………………………………………………………………………………………

$

13. Distributor discount for timely filed reports and payment of tax (multiply line 12 by .01)…………………………………………………………………………………………………………………………………………………………

$

14. Total snuff tax due (line 12 minus line 13)….…...………………………………………………………………………………………………………………………………

02

$

05

15. Total chewing tobacco tax due (from page 2, line 40)…………...……….………………..……………………..………………………………………….……..………….

$

16. Total tax due for tobacco products, snuff, and chewing tobacco (add lines 7, 14, and 15)…………..………………………………….………………………………………………………………………………………………

$

IMPORTANT NOTICE: Make check(s) payable to Kentucky State Treasurer.

Mail report and check(s) to Kentucky Department of Revenue, Frankfort, Kentucky 40619.

I, the undersigned, a principal officer of the above-named company, certify that I have examined this report and it is, to the best of my knowledge and belief, a true, correct and complete

report.

_____________________________________________________

__________________________

_____________________________________

Signature

Date

Title

_____________________________________________________

_______________________________________________________________________

Print Name

Email

1

1 2

2 3

3