Reset

Print Form

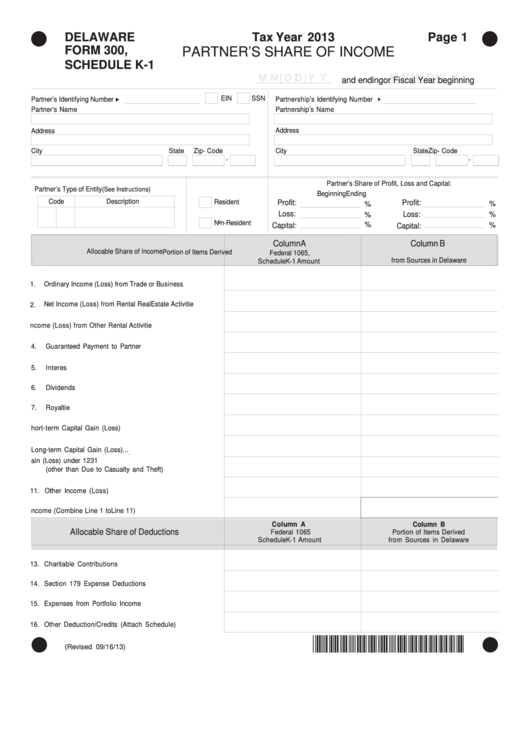

DELAWARE

Tax Year 2013

Page 1

FORM 300,

PARTNER’S SHARE OF INCOME

SCHEDULE K-1

or Fiscal Year beginning

and ending

EIN

SSN

Partner’s Identifying Number

Partnership’s Identifying Number

Partner’s Name

Partnership’s Name

Address

Address

City

State

Zip- Code

City

State

Zip- Code

-

-

Partner’s Share of Profit, Loss and Capital:

Partner’s Type of Entity

(See Instructions)

Beginning

Ending

Code

Description

Resident

Profit:

Profit:

%

%

Loss:

Loss:

%

%

Non-Resident

%

%

Capital:

Capital:

Column A

Column B

Allocable Share of Income

Portion of Items Derived

Federal 1065,

from Sources in Delaware

Schedule K-1 Amount

1.

Ordinary Income (Loss) from Trade or Business Activities...

Net Income (Loss) from Rental Real Estate Activities.........

2.

3.

Net Income (Loss) from Other Rental Activities.................

4.

Guaranteed Payment to Partner......................................

5.

Interest...........................................................................

6.

Dividends........................................................................

7.

Royalties.........................................................................

8.

Net Short-term Capital Gain (Loss)..................................

9.

Net Long-term Capital Gain (Loss).................................. .

10. Net Gain (Loss) under 1231

(other than Due to Casualty and Theft)............................

11. Other Income (Loss).......................................................

12. Total Income (Combine Line 1 to Line 11).........................

Column A

Column B

Allocable Share of Deductions

Federal 1065

Portion of Items Derived

Schedule K-1 Amount

from Sources in Delaware

13. Charitable Contributions.................................................

14. Section 179 Expense Deductions....................................

15. Expenses from Portfolio Income......................................

16. Other Deduction/Credits (Attach Schedule)....................

*DF30113019999*

(Revised 09/16/13)

1

1