Instructions For Form Ct-1 - Supplement To Corporation Tax Instructions - 2014

ADVERTISEMENT

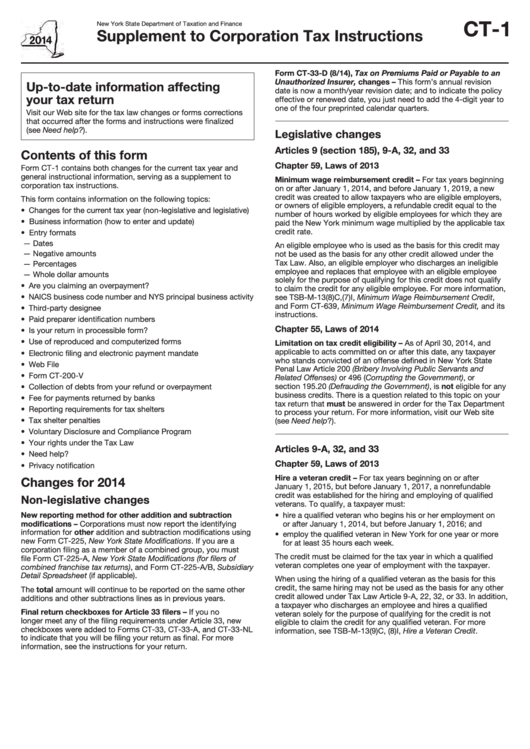

CT-1

New York State Department of Taxation and Finance

Supplement to Corporation Tax Instructions

Form CT-33-D (8/14), Tax on Premiums Paid or Payable to an

Unauthorized Insurer, changes – This form’s annual revision

Up-to-date information affecting

date is now a month/year revision date; and to indicate the policy

your tax return

effective or renewed date, you just need to add the 4-digit year to

one of the four preprinted calendar quarters.

Visit our Web site for the tax law changes or forms corrections

that occurred after the forms and instructions were finalized

(see Need help?).

Legislative changes

Articles 9 (section 185), 9-A, 32, and 33

Contents of this form

Chapter 59, Laws of 2013

Form CT-1 contains both changes for the current tax year and

general instructional information, serving as a supplement to

Minimum wage reimbursement credit – For tax years beginning

corporation tax instructions.

on or after January 1, 2014, and before January 1, 2019, a new

credit was created to allow taxpayers who are eligible employers,

This form contains information on the following topics:

or owners of eligible employers, a refundable credit equal to the

• Changes for the current tax year (non-legislative and legislative)

number of hours worked by eligible employees for which they are

• Business information (how to enter and update)

paid the New York minimum wage multiplied by the applicable tax

credit rate.

• Entry formats

— Dates

An eligible employee who is used as the basis for this credit may

— Negative amounts

not be used as the basis for any other credit allowed under the

Tax Law. Also, an eligible employer who discharges an ineligible

— Percentages

employee and replaces that employee with an eligible employee

— Whole dollar amounts

solely for the purpose of qualifying for this credit does not qualify

• Are you claiming an overpayment?

to claim the credit for any eligible employee. For more information,

• NAICS business code number and NYS principal business activity

see TSB-M-13(8)C,(7)I, Minimum Wage Reimbursement Credit,

and Form CT-639, Minimum Wage Reimbursement Credit, and its

• Third-party designee

instructions.

• Paid preparer identification numbers

Chapter 55, Laws of 2014

• Is your return in processible form?

• Use of reproduced and computerized forms

Limitation on tax credit eligibility – As of April 30, 2014, and

applicable to acts committed on or after this date, any taxpayer

• Electronic filing and electronic payment mandate

who stands convicted of an offense defined in New York State

• Web File

Penal Law Article 200 (Bribery Involving Public Servants and

• Form CT-200-V

Related Offenses) or 496 (Corrupting the Government), or

section 195.20 (Defrauding the Government), is not eligible for any

• Collection of debts from your refund or overpayment

business credits. There is a question related to this topic on your

• Fee for payments returned by banks

tax return that must be answered in order for the Tax Department

• Reporting requirements for tax shelters

to process your return. For more information, visit our Web site

• Tax shelter penalties

(see Need help?).

• Voluntary Disclosure and Compliance Program

• Your rights under the Tax Law

Articles 9-A, 32, and 33

• Need help?

Chapter 59, Laws of 2013

• Privacy notification

Hire a veteran credit – For tax years beginning on or after

Changes for 2014

January 1, 2015, but before January 1, 2017, a nonrefundable

credit was established for the hiring and employing of qualified

Non-legislative changes

veterans. To qualify, a taxpayer must:

New reporting method for other addition and subtraction

• hire a qualified veteran who begins his or her employment on

modifications – Corporations must now report the identifying

or after January 1, 2014, but before January 1, 2016; and

information for other addition and subtraction modifications using

• employ the qualified veteran in New York for one year or more

new Form CT-225, New York State Modifications. If you are a

for at least 35 hours each week.

corporation filing as a member of a combined group, you must

The credit must be claimed for the tax year in which a qualified

file Form CT-225-A, New York State Modifications (for filers of

veteran completes one year of employment with the taxpayer.

combined franchise tax returns), and Form CT-225-A/B, Subsidiary

Detail Spreadsheet (if applicable).

When using the hiring of a qualified veteran as the basis for this

credit, the same hiring may not be used as the basis for any other

The total amount will continue to be reported on the same other

credit allowed under Tax Law Article 9-A, 22, 32, or 33. In addition,

additions and other subtractions lines as in previous years.

a taxpayer who discharges an employee and hires a qualified

Final return checkboxes for Article 33 filers – If you no

veteran solely for the purpose of qualifying for the credit is not

longer meet any of the filing requirements under Article 33, new

eligible to claim the credit for any qualified veteran. For more

checkboxes were added to Forms CT-33, CT-33-A, and CT-33-NL

information, see TSB-M-13(9)C, (8)I, Hire a Veteran Credit.

to indicate that you will be filing your return as final. For more

information, see the instructions for your return.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5