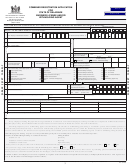

DETAILED LIST OF DIVISION OF REVENUE LICENSES AND TAX RATES

Tax Rate

Tax Rate

Business

Annual Additional

Returns

Category

Effective

Effective

Exclusion

Group Code

Fee

Locations

Due

1/1/10

1/1/12

Private Detective

75

25

0.004147

0.004023

Monthly

100,000

183

(State Police Approval Required)

Professional Services

75

25

0.004147

0.004023

Monthly

100,000

007

–

Public Utilities

Monthly

0.500/0.235 0.425/0.200

701

–

–

–

Cable Television and Satellite

0.02125

0.02125

Monthly y

–

–

707

–

Telecommunications

Monthly

709

–

–

0.500/0.235 0.425/0.200

–

[5]Electric Utility

–

–

0.0500

0.0500

Monthly

708

Gas Utility

–

–

0.0500

0.0500

Monthly

–

704

[6] Telephone & Telegraph Wire Tax

–

Annually

702 Contact the Division of Revenue at 302-577-8778.

75

25

0.004147

0.004023

Monthly

100,000

Real Estate Broker

581

393

75

25

0.006739

0.006537

Monthly

100,000

Restaurant Retailer

[8] Retailer -General

396

90

40

0.007776

0.007543

Monthly

100,000

90

40

0.007776

0.007543

Monthly

100,000

400

[8] Transient

(Registration & Bonding Required)

403

40

–

0.007776

0.007543

After 10th day 3,000

*[8] Transient 10 days or less

–

–

$0.04/bottle sold

Monthly

–

[9] Retail - Bottle Sales (Effective12/01/10)

407

–

–

–

–

$2.00/tire sold $2.00/tire sold Monthly

[10] Retail - Tire Sales

(Effective01/01/07)

406

75

–

–

–

–

–

186

Sales Representative

75

25

0.004147

0.004023

Monthly

100,000

Security Guard Co.

183

(State Police Approval Required)

115

25

0.004147

0.004023

Monthly

100,000

100

Security Systems

(State Police Approval Required)

375

–

–

–

–

–

Showperson

189

50

1st year

0.001

0.001

Annually

Steam, Gas & Electric

703

45

30

–

–

–

–

Taxicab or Bus Operator --1st Veh / Each

173

[2] Tourist Home--Per Room (Min. 5 Rooms)

15

–

0.08

0.08

Monthly

–

192

10

–

–

–

–

–

193

Trailer Park --Each Space

405

90

90

0.007776

0.007543

Monthly

100,000

[8]

Transient Nursery Retailer

056

–

–

–

–

75

25

Transportation Agent

225

25

–

–

–

–

097

Travel Agency

Machine Decals

75

–

–

–

–

–

131

Amusement Machine

5

–

–

–

–

–

Vending Machine --Each Machine

399

3

–

–

–

–

–

Cigarette --Each Machine

212

(Business License Also Needed)

377

75

75

0.004147

0.004023

Monthly

100,000

Wholesalers

* Those categories marked with an asterisk (*) are not proratable and the full amount must be paid.

[1]Grocery Supermarkets –

The 2012 tax rate for the first $2 million is .0033 and .006181 on the remaining taxable gross receipts.

The 2010 tax rate for the first $2 million is .003402 and .006372 on the remaining taxable gross receipts.

[2]Hotels, Motels and Tourist Homes – The eight percent (8%) tax is collected from the guest and remitted to the Division of Revenue.

[3]Petroleum Retailers –

The 2012 composite rate includes the General Fund tax of .007543 and a Hazardous Substance tax of .009.

The 2010 composite rate includes the General Fund tax of .007776 and a Hazardous Substance tax of .009.

[4]Petroleum Wholesalers –

The 2012 composite rate includes the General Fund tax of .004023, a Hazardous Substance tax of .009 and surtax of .002514.

The 2010 composite rate includes the General Fund tax of .004147, a Hazardous Substance tax of .009 and surtax of .002592.

[5]Electric Utility – The tax rate is .0235 (Effective 8/01/09) for electric consumed by manufacturers, food processors and agribusinesses.

[6]Interstate calls are exempt.

[7]Motor Vehicle Dealer – House Bill 163, effective August, 1999, requires Motor Vehicle Dealers who self-finance any sale of a motor

vehicle to a retail buyer without charging interest to file an original surety bond in the principal sum of $25,000 with the Division of Revenue.

[8]Retail Crime Fee – This license fee includes an additional $15.00. This is an annual fee assessed in accordance with HB 458 of the

144th General Assembly.

[9]Retail Bottle Fee –

The Bottle Fee (or Beverage Container Recycling Fee) applies only to non-aluminous containers containing less than

two quarts of a carbonated beverage that are consumed off the seller’s premises. This includes: carbonated mineral water (except naturally

sparkling mineral water), soda water, non-alcoholic carbonated beverages (”soft drinks”), beer, ale, and alcoholic malt beverages. Exemptions

to the Bottle Fee include beverages sold at retail by non-profit organizations.

[10] Retail Tire License and Scrap Tire Fee – Exemptions include tires sold for farm tractors and off-highway vehicles (dirt bikes,

off-road ATVs), tires sold as part of a vehicle sale, and wholesale tire sales.

7

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14