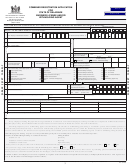

COMBINED REGISTRATION APPLICATION FORM

1. This Combined Registration Application form must be completed by all persons or companies conducting any

business activity in Delaware or having one or more employees who work in the State of Delaware or who are

residents of Delaware for whom you are deducting Delaware income tax. Part A is to be completed by all

taxpayers. Part B must be completed by any person or company paying Delaware withholding tax. Part C must be

completed by taxpayers applying for a Delaware Business License(s). The attachment for Contractors Only is to be

attached to the application along with the other appropriate forms listed. The Initial Employer's Report of Delaware

Tax Withheld and the Initial Gross Receipts Tax Return are only to be used for your FIRST time filing of these

returns. Separate checks must accompany each type of tax return(s) you file. A separate Initial Gross Receipts Tax

Return must be filed for each type of license acquired.

2. You should receive your personalized Withholding and Gross Receipts forms by the time your next return is due. If

you have not received your forms, contact the Business Master File Section at (302) 577-8778. If you have

questions concerning the completion of the forms, contact the Withholding Tax Section at (302) 577-8779; or the

Gross Receipts Section at (302) 577-8780.

3. All questions in Part A MUST be answered; if not applicable, write “NA” in the answer block.

4. This application may not be accepted if all necessary information is not provided.

5. This application must be signed at the end of Part C by the owner or officer and dated.

6. Mail completed application with the required license fee, if applicable, to DIVISION OF REVENUE, P.O. BOX

8750, WILMINGTON, DELAWARE 19899-8750.

SPECIFIC INSTRUCTIONS - PLEASE READ CAREFULLY - PLEASE PRINT CLEARLY OR TYPE.

Line 1. Enter your Federal Employer Identification Number or Social Security number, whichever is used for federal

purposes. If you are an employer or your business ownership is not that of a Sole Proprietorship, you must have

a Federal Employer Identification number. You can apply for a number using Federal Form SS-4. (Call your

nearest IRS office.) If you have applied for a Federal Employer Identification number, please enter "APPLIED

FOR" on Line 1 and the Division of Revenue will assign a temporary number until your Federal Identification

number has been received. Notify the Business Master File Unit at (302) 577-8778, when your Federal

Employer Identification Number is obtained. All of your tax returns should be filed under ONE

identification number. If you are a sole proprietor and you have a federal identification number, you must

enter both numbers on Line 1 of Part A and Part C.

Line 2. Enter the name of the business (individual, partnership, corporate name, governmental agency, etc.).

Line 3. Enter the trade name of your business if different from the primary business name on Line 2.

Line 4. Enter the address of your primary business location. (A Post Office Box is NOT an acceptable location

address.)

Line 5. Enter the address to which correspondence should be mailed if different from your primary business location. If

you have a PO Box, enter that information here.

Line 6. If your business operates on a seasonal basis, enter the month your seasonal activity begins and ends.

Line 7. Please check the appropriate box which indicates the period of your taxable year. If you are a fiscal year

taxpayer, please enter the last month and day of the taxable year.

Line 8. If incorporated, enter the State in which incorporated.

Line 9. If incorporated, enter the date on which incorporated.

Line 10. Enter the date your business operations began or will begin in Delaware.

Line 11. Check the appropriate box which describes your legal form of business. If you are a sole proprietor and you

have a federal identification number, please ensure that you have entered both numbers on Line 1. If you

are registering to remit withholding taxes for a person performing domestic services in your home, indicate

your type of ownership as #18 Employer-Domestic Employees. If you are only registering to be a withholding

agent as a convenience to your employees and are not conducting business in Delaware, Check Type

ownership #35, Withholding Agent Only.

Line 12. On line 11 if you have checked 06 - Sub Chapter S Corporation, please indicate if you have Shareholders that

are NOT Delaware residents.

Line 13. Enter the parent company's name.

Line 14. Enter the parent company's identification number.

Line 15. Enter the previous name of your business if it has been changed.

Line 16. Enter the previous identification number of your business if it has been changed.

Line 17. Enter the name, title, phone number, fax number and e-mail address of the individual who should be contacted

regarding tax matters.

Line 18. Enter the name, title and social security number of the proprietor, partners or principal officers of your

business. If more than three, please attach a separate list. If you have a Registered Agent, provide that

information also.

Line 19. Fully describe the specific nature of your business.

NOTE: Without a COMPLETE application, we cannot process the forms necessary for your filing requirements.

2

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14