PRINT FORM

RESET FORM

FORM

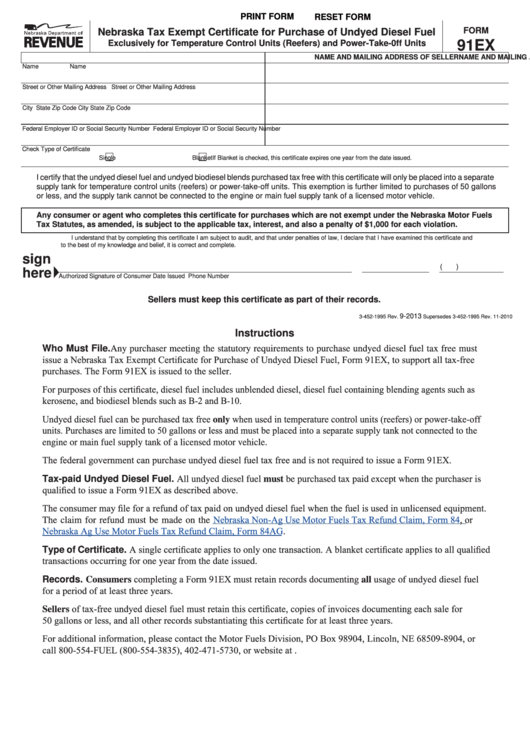

Nebraska Tax Exempt Certificate for Purchase of Undyed Diesel Fuel

Exclusively for Temperature Control Units (Reefers) and Power-Take-0ff Units

91EX

NAME AND MAILING ADDRESS OF CONSUMER

NAME AND MAILING ADDRESS OF SELLER

Name

Name

Street or Other Mailing Address

Street or Other Mailing Address

City

State

Zip Code

City

State

Zip Code

Federal Employer ID or Social Security Number

Federal Employer ID or Social Security Number

Check Type of Certificate

Single

Blanket

If Blanket is checked, this certificate expires one year from the date issued.

I certify that the undyed diesel fuel and undyed biodiesel blends purchased tax free with this certificate will only be placed into a separate

supply tank for temperature control units (reefers) or power-take-off units. This exemption is further limited to purchases of 50 gallons

or less, and the supply tank cannot be connected to the engine or main fuel supply tank of a licensed motor vehicle.

Any consumer or agent who completes this certificate for purchases which are not exempt under the Nebraska Motor Fuels

Tax Statutes, as amended, is subject to the applicable tax, interest, and also a penalty of $1,000 for each violation.

I understand that by completing this certificate I am subject to audit, and that under penalties of law, I declare that I have examined this certificate and

to the best of my knowledge and belief, it is correct and complete.

sign

(

)

here

Authorized Signature of Consumer

Date Issued

Phone Number

Sellers must keep this certificate as part of their records.

9-2013

3-452-1995 Rev.

Supersedes 3-452-1995 Rev. 11-2010

Instructions

Who Must File. Any purchaser meeting the statutory requirements to purchase undyed diesel fuel tax free must

issue a Nebraska Tax Exempt Certificate for Purchase of Undyed Diesel Fuel, Form 91EX, to support all tax-free

purchases. The Form 91EX is issued to the seller.

For purposes of this certificate, diesel fuel includes unblended diesel, diesel fuel containing blending agents such as

kerosene, and biodiesel blends such as B-2 and B-10.

Undyed diesel fuel can be purchased tax free only when used in temperature control units (reefers) or power-take-off

units. Purchases are limited to 50 gallons or less and must be placed into a separate supply tank not connected to the

engine or main fuel supply tank of a licensed motor vehicle.

The federal government can purchase undyed diesel fuel tax free and is not required to issue a Form 91EX.

Tax-paid Undyed Diesel Fuel. All undyed diesel fuel must be purchased tax paid except when the purchaser is

qualified to issue a Form 91EX as described above.

The consumer may file for a refund of tax paid on undyed diesel fuel when the fuel is used in unlicensed equipment.

Nebraska Non-Ag Use Motor Fuels Tax Refund Claim, Form

84, or

The claim for refund must be made on the

Nebraska Ag Use Motor Fuels Tax Refund Claim, Form

84AG.

Type of Certificate. A single certificate applies to only one transaction. A blanket certificate applies to all qualified

transactions occurring for one year from the date issued.

Records. Consumers completing a Form 91EX must retain records documenting all usage of undyed diesel fuel

for a period of at least three years.

Sellers of tax-free undyed diesel fuel must retain this certificate, copies of invoices documenting each sale for

50 gallons or less, and all other records substantiating this certificate for at least three years.

For additional information, please contact the Motor Fuels Division, PO Box 98904, Lincoln, NE 68509-8904, or

call 800-554-FUEL (800-554-3835), 402-471-5730, or website at revenue.ne.gov/fuels.

1

1