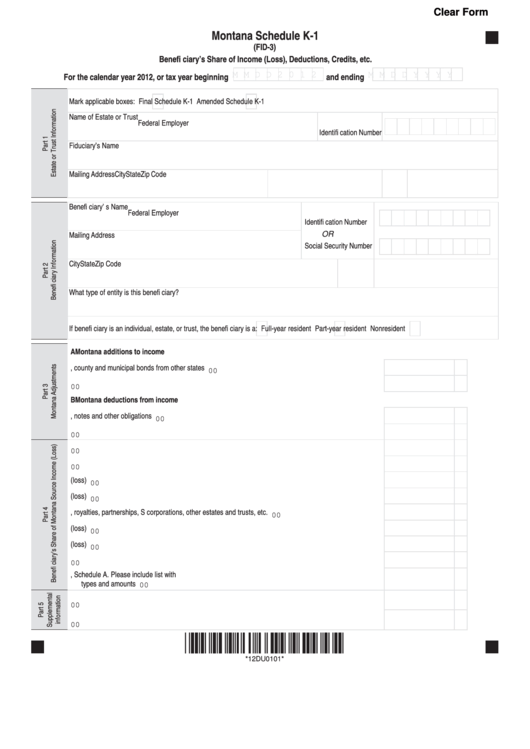

Clear Form

Montana Schedule K-1

(FID-3)

Benefi ciary’s Share of Income (Loss), Deductions, Credits, etc.

M M D D 2 0 1 2

M M D D Y Y Y Y

For the calendar year 2012, or tax year beginning

and ending

Mark applicable boxes:

Final Schedule K-1

Amended Schedule K-1

Name of Estate or Trust

Federal Employer

Identifi cation Number

Fiduciary’s Name

Mailing Address

City

State

Zip Code

Benefi ciary’ s Name

Federal Employer

Identifi cation Number

Mailing Address

OR

Social Security Number

City

State

Zip Code

What type of entity is this benefi ciary?

If benefi ciary is an individual, estate, or trust, the benefi ciary is a:

Full-year resident

Part-year resident

Nonresident

A Montana additions to income

1. Interest and mutual fund dividends from state, county and municipal bonds from other states ............... A1.

00

2. Other additions. List type __________________________________________________ and amount. A2.

00

B Montana deductions from income

1. Exempt interest and mutual fund dividends from federal bonds, notes and other obligations ................. B1.

00

2. Other deductions. List type ________________________________________________ and amount. B2.

00

1. Interest income ............................................................................................................................................1.

00

2. Dividends .....................................................................................................................................................2.

00

3. Business income or (loss) ...........................................................................................................................3.

00

4. Capital gain or (loss) ....................................................................................................................................4.

00

5. Rents, royalties, partnerships, S corporations, other estates and trusts, etc. .............................................5.

00

6. Net farm income or (loss) ............................................................................................................................6.

00

7. Ordinary gain or (loss) .................................................................................................................................7.

00

8. Other income. List type ____________________________________________________ and amount. 8.

00

9. Montana source additions to income reported on Form FID-3, Schedule A. Please include list with

types and amounts ......................................................................................................................................9.

00

1. Montana mineral royalty tax withheld ..........................................................................................................1.

00

2. Other information. List type _________________________________________________ and amount. 2.

00

*12DU0101*

*12DU0101*

1

1 2

2