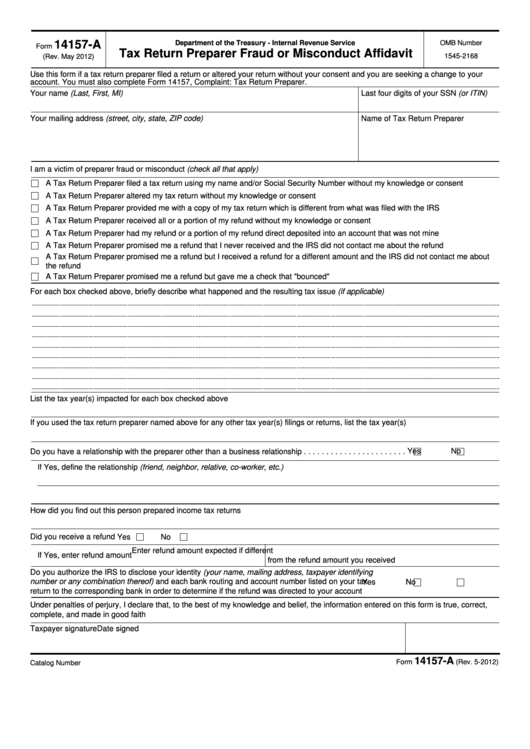

14157-A

Department of the Treasury - Internal Revenue Service

OMB Number

Form

Tax Return Preparer Fraud or Misconduct Affidavit

1545-2168

(Rev. May 2012)

Use this form if a tax return preparer filed a return or altered your return without your consent and you are seeking a change to your

account. You must also complete Form 14157, Complaint: Tax Return Preparer.

Your name (Last, First, MI)

Last four digits of your SSN (or ITIN)

Your mailing address (street, city, state, ZIP code)

Name of Tax Return Preparer

I am a victim of preparer fraud or misconduct (check all that apply)

A Tax Return Preparer filed a tax return using my name and/or Social Security Number without my knowledge or consent

A Tax Return Preparer altered my tax return without my knowledge or consent

A Tax Return Preparer provided me with a copy of my tax return which is different from what was filed with the IRS

A Tax Return Preparer received all or a portion of my refund without my knowledge or consent

A Tax Return Preparer had my refund or a portion of my refund direct deposited into an account that was not mine

A Tax Return Preparer promised me a refund that I never received and the IRS did not contact me about the refund

A Tax Return Preparer promised me a refund but I received a refund for a different amount and the IRS did not contact me about

the refund

A Tax Return Preparer promised me a refund but gave me a check that "bounced"

For each box checked above, briefly describe what happened and the resulting tax issue (if applicable)

List the tax year(s) impacted for each box checked above

If you used the tax return preparer named above for any other tax year(s) filings or returns, list the tax year(s)

Yes

No

Do you have a relationship with the preparer other than a business relationship . . . . . . . . . . . . . . . . . . . . . . .

If Yes, define the relationship (friend, neighbor, relative, co-worker, etc.)

How did you find out this person prepared income tax returns

Did you receive a refund

Yes

No

Enter refund amount expected if different

If Yes, enter refund amount

from the refund amount you received

Do you authorize the IRS to disclose your identity (your name, mailing address, taxpayer identifying

number or any combination thereof) and each bank routing and account number listed on your tax

Yes

No

return to the corresponding bank in order to determine if the refund was directed to your account

Under penalties of perjury, I declare that, to the best of my knowledge and belief, the information entered on this form is true, correct,

complete, and made in good faith

Taxpayer signature

Date signed

14157-A

Form

(Rev. 5-2012)

Catalog Number 59567Y

1

1 2

2