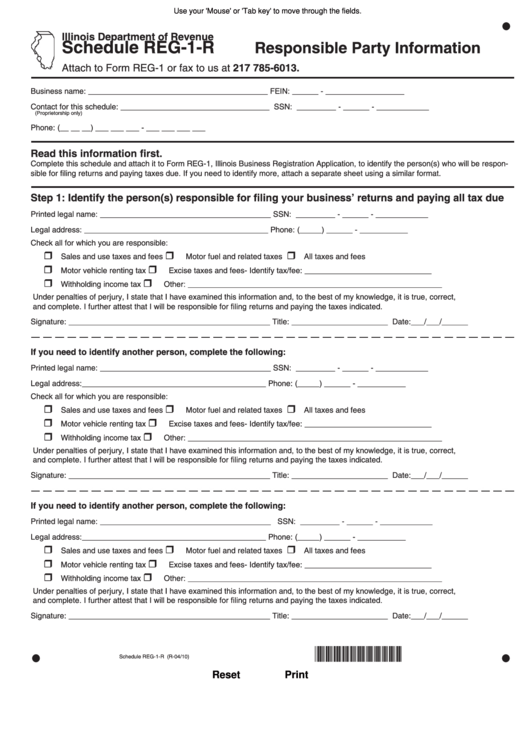

Use your 'Mouse' or 'Tab key' to move through the fields.

Illinois Department of Revenue

Schedule REG-1-R

Responsible Party Information

Attach to Form REG-1 or fax to us at 217 785-6013.

Business name: _________________________________________

FEIN: ______ - __________________

Contact for this schedule: __________________________________

SSN:

_________ - ______ - ____________

(Proprietorship only)

Phone: (__ __ __) ___ ___ ___ - ___ ___ ___ ___

Read this information first.

Complete this schedule and attach it to Form REG-1, Illinois Business Registration Application, to identify the person(s) who will be respon-

sible for filing returns and paying taxes due. If you need to identify more, attach a separate sheet using a similar format.

Step 1: Identify the person(s) responsible for filing your business’ returns and paying all tax due

Printed legal name: _______________________________________

SSN:

_________ - ______ - ____________

Legal address: __________________________________________

Phone: (_____) ______ - ___________

Check all for which you are responsible:

Sales and use taxes and fees

Motor fuel and related taxes

All taxes and fees

Motor vehicle renting tax

Excise taxes and fees- Identify tax/fee: _____________________________

Withholding income tax

Other: __________________________________________________________

Under penalties of perjury, I state that I have examined this information and, to the best of my knowledge, it is true, correct,

and complete. I further attest that I will be responsible for filing returns and paying the taxes indicated.

Signature: ______________________________________________

Title: ______________________

Date:___/___/______

If you need to identify another person, complete the following:

Printed legal name: _______________________________________

SSN:

_________ - ______ - ____________

Legal address:__________________________________________

Phone: (_____) ______ - ___________

Check all for which you are responsible:

Sales and use taxes and fees

Motor fuel and related taxes

All taxes and fees

Motor vehicle renting tax

Excise taxes and fees- Identify tax/fee: _____________________________

Withholding income tax

Other: __________________________________________________________

Under penalties of perjury, I state that I have examined this information and, to the best of my knowledge, it is true, correct,

and complete. I further attest that I will be responsible for filing returns and paying the taxes indicated.

Signature: ______________________________________________

Title: ______________________

Date:___/___/______

If you need to identify another person, complete the following:

Printed legal name: _______________________________________

SSN:

_________ - ______ - ____________

Legal address:__________________________________________

Phone: (_____) ______ - ___________

Sales and use taxes and fees

Motor fuel and related taxes

All taxes and fees

Motor vehicle renting tax

Excise taxes and fees- Identify tax/fee: _____________________________

Withholding income tax

Other: __________________________________________________________

Under penalties of perjury, I state that I have examined this information and, to the best of my knowledge, it is true, correct,

and complete. I further attest that I will be responsible for filing returns and paying the taxes indicated.

Signature: ______________________________________________

Title: ______________________

Date:___/___/______

*045501110*

Schedule REG-1-R (R-04/10)

Reset

Print

1

1