Form Dr-1s - Registration Application For Secondhand Dealers And/or Secondary Metals Recyclers

ADVERTISEMENT

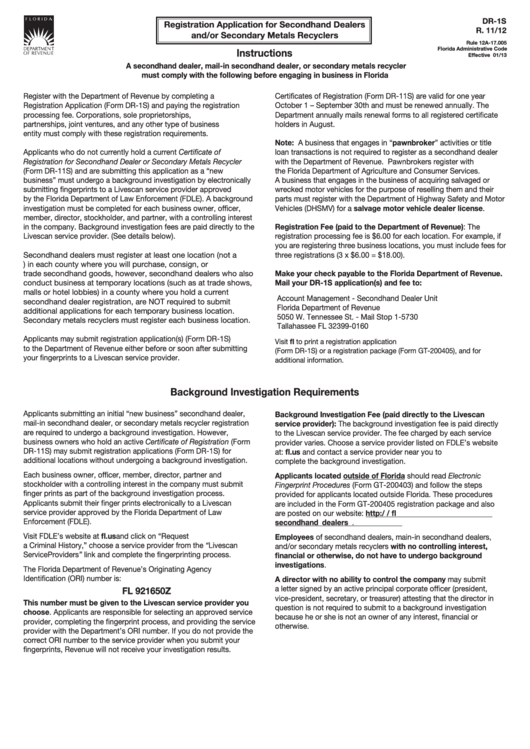

DR-1S

Registration Application for Secondhand Dealers

R. 11/12

and/or Secondary Metals Recyclers

Rule 12A-17.005

Florida Administrative Code

Instructions

Effective 01/13

A secondhand dealer, mail-in secondhand dealer, or secondary metals recycler

must comply with the following before engaging in business in Florida

Certificates of Registration (Form DR-11S) are valid for one year

Register with the Department of Revenue by completing a

Registration Application (Form DR-1S) and paying the registration

October 1 – September 30th and must be renewed annually. The

processing fee. Corporations, sole proprietorships,

Department annually mails renewal forms to all registered certificate

partnerships, joint ventures, and any other type of business

holders in August.

entity must comply with these registration requirements.

Note: A business that engages in “pawnbroker” activities or title

Applicants who do not currently hold a current Certificate of

loan transactions is not required to register as a secondhand dealer

Registration for Secondhand Dealer or Secondary Metals Recycler

with the Department of Revenue. Pawnbrokers register with

(Form DR-11S) and are submitting this application as a “new

the Florida Department of Agriculture and Consumer Services.

business” must undergo a background investigation by electronically

A business that engages in the business of acquiring salvaged or

submitting fingerprints to a Livescan service provider approved

wrecked motor vehicles for the purpose of reselling them and their

by the Florida Department of Law Enforcement (FDLE). A background

parts must register with the Department of Highway Safety and Motor

investigation must be completed for each business owner, officer,

Vehicles (DHSMV) for a salvage motor vehicle dealer license.

member, director, stockholder, and partner, with a controlling interest

in the company. Background investigation fees are paid directly to the

Registration Fee (paid to the Department of Revenue): The

Livescan service provider. (See details below).

registration processing fee is $6.00 for each location. For example, if

you are registering three business locations, you must include fees for

Secondhand dealers must register at least one location (not a

three registrations (3 x $6.00 = $18.00).

P.O. Box) in each county where you will purchase, consign, or

trade secondhand goods, however, secondhand dealers who also

Make your check payable to the Florida Department of Revenue.

Mail your DR-1S application(s) and fee to:

conduct business at temporary locations (such as at trade shows,

malls or hotel lobbies) in a county where you hold a current

Account Management - Secondhand Dealer Unit

secondhand dealer registration, are NOT required to submit

Florida Department of Revenue

additional applications for each temporary business location.

5050 W. Tennessee St. - Mail Stop 1-5730

Secondary metals recyclers must register each business location.

Tallahassee FL 32399-0160

Applicants may submit registration application(s) (Form DR-1S)

Visit to print a registration application

to the Department of Revenue either before or soon after submitting

(Form DR-1S) or a registration package (Form GT-200405), and for

your fingerprints to a Livescan service provider.

additional information.

Background Investigation Requirements

Applicants submitting an initial “new business” secondhand dealer,

Background Investigation Fee (paid directly to the Livescan

mail-in secondhand dealer, or secondary metals recycler registration

service provider): The background investigation fee is paid directly

are required to undergo a background investigation. However,

to the Livescan service provider. The fee charged by each service

business owners who hold an active Certificate of Registration (Form

provider varies. Choose a service provider listed on FDLE’s website

DR-11S) may submit registration applications (Form DR-1S) for

at: and contact a service provider near you to

additional locations without undergoing a background investigation.

complete the background investigation.

Each business owner, officer, member, director, partner and

Applicants located outside of Florida should read Electronic

stockholder with a controlling interest in the company must submit

Fingerprint Procedures (Form GT-200403) and follow the steps

finger prints as part of the background investigation process.

provided for applicants located outside Florida. These procedures

Applicants submit their finger prints electronically to a Livescan

are included in the Form GT-200405 registration package and also

service provider approved by the Florida Department of Law

are posted on our website: http:/

Enforcement (FDLE).

secondhand_dealers_recyclers.html.

Visit FDLE’s website at and click on “Request

Employees of secondhand dealers, main-in secondhand dealers,

a Criminal History,” choose a service provider from the “Livescan

and/or secondary metals recyclers with no controlling interest,

Service Providers” link and complete the fingerprinting process.

financial or otherwise, do not have to undergo background

investigations.

The Florida Department of Revenue’s Originating Agency

Identification (ORI) number is:

A director with no ability to control the company may submit

a letter signed by an active principal corporate officer (president,

FL 921650Z

vice-president, secretary, or treasurer) attesting that the director in

This number must be given to the Livescan service provider you

question is not required to submit to a background investigation

choose. Applicants are responsible for selecting an approved service

because he or she is not an owner of any interest, financial or

provider, completing the fingerprint process, and providing the service

otherwise.

provider with the Department’s ORI number. If you do not provide the

correct ORI number to the service provider when you submit your

fingerprints, Revenue will not receive your investigation results.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4