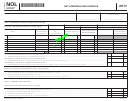

Form 720 - Net Operating Loss Schedule - 2012

ADVERTISEMENT

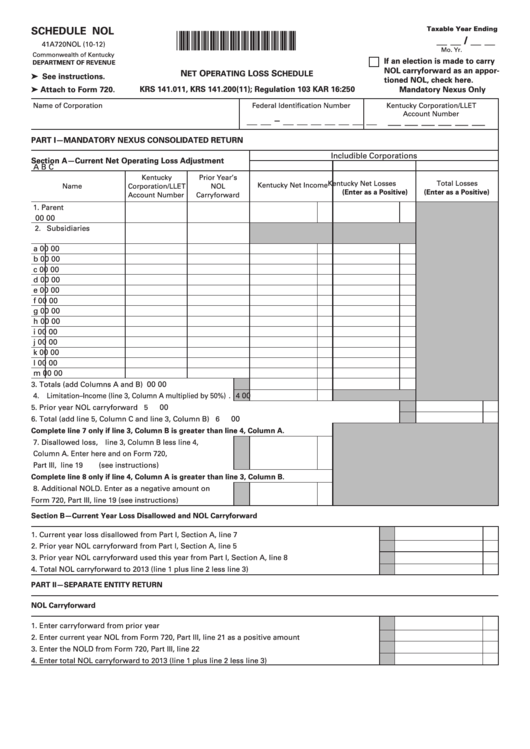

SCHEDULE NOL

Taxable Year Ending

*1200020217*

__ __ / __ __

41A720NOL (10-12)

Mo.

Yr.

Commonwealth of Kentucky

If an election is made to carry

DEPARTMENT OF REVENUE

NOL carryforward as an appor-

N

O

L

S

ET

PERATING

OSS

CHEDULE

➤ See instructions.

tioned NOL, check here.

➤ Attach to Form 720.

KRS 141.011, KRS 141.200(11); Regulation 103 KAR 16:250

Mandatory Nexus Only

Name of Corporation

Federal Identification Number

Kentucky Corporation/LLET

Account Number

__ __ __ __ __ __

__ __ – __ __ __ __ __ __ __

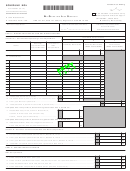

PART I—MANDATORY NEXUS CONSOLIDATED RETURN

Includible Corporations

Section A—Current Net Operating Loss Adjustment

A

B

C

Kentucky

Prior Year’s

Kentucky Net Losses

Total Losses

Kentucky Net Income

Name

Corporation/LLET

NOL

(Enter as a Positive)

(Enter as a Positive)

Account Number

Carryforward

1. Parent

00

00

2. Subsidiaries

a

00

00

b

00

00

c

00

00

d

00

00

e

00

00

f

00

00

g

00

00

h

00

00

i

00

00

j

00

00

k

00

00

l

00

00

m

00

00

00

00

3. Totals (add Columns A and B) .......................................

3

00

4. Limitation–Income (line 3, Column A multiplied by 50%) .

4

5. Prior year NOL carryforward ...........................................................................................................................

5

00

00

6. Total (add line 5, Column C and line 3, Column B) .......................................................................................

6

Complete line 7 only if line 3, Column B is greater than line 4, Column A.

7. Disallowed loss, line 3, Column B less line 4,

Column A. Enter here and on Form 720,

Part III, line 19 (see instructions) .................................

7

00

Complete line 8 only if line 4, Column A is greater than line 3, Column B.

8. Additional NOLD. Enter as a negative amount on

Form 720, Part III, line 19 (see instructions) ................

8

00

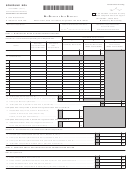

Section B—Current Year Loss Disallowed and NOL Carryforward

1. Current year loss disallowed from Part I, Section A, line 7 ................................................................

1

00

2. Prior year NOL carryforward from Part I, Section A, line 5 ................................................................

2

00

3. Prior year NOL carryforward used this year from Part I, Section A, line 8 .......................................

3

00

4. Total NOL carryforward to 2013 (line 1 plus line 2 less line 3) ...........................................................

4

00

PART II—SEPARATE ENTITY RETURN

NOL Carryforward

1. Enter carryforward from prior year ......................................................................................................

1

00

2. Enter current year NOL from Form 720, Part III, line 21 as a positive amount .................................

2

00

3. Enter the NOLD from Form 720, Part III, line 22 ..................................................................................

3

00

4. Enter total NOL carryforward to 2013 (line 1 plus line 2 less line 3) ..................................................

4

00

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2