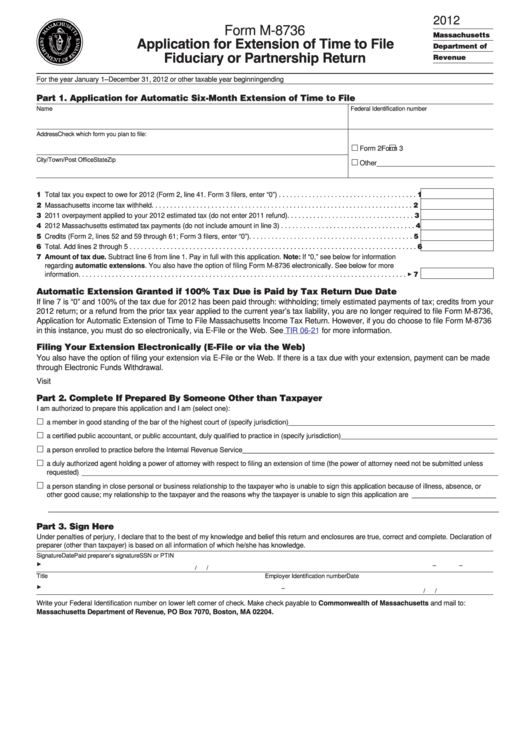

2012

Form M-8736

Massachusetts

Application for Extension of Time to File

Department of

Fiduciary or Partnership Return

Revenue

For the year January 1–December 31, 2012 or other taxable year beginning

ending

Part 1. Application for Automatic Six-Month Extension of Time to File

Name

Federal Identification number

Address

Check which form you plan to file:

Form 2

Form 3

City/Town/Post Office

State

Zip

Other_______________________________

1 Total tax you expect to owe for 2012 (Form 2, line 41. Form 3 filers, enter “0”) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

2 Massachusetts income tax withheld . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

3 2011 overpayment applied to your 2012 estimated tax (do not enter 2011 refund) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

4 2012 Massachusetts estimated tax payments (do not include amount in line 3) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

5 Credits (Form 2, lines 52 and 59 through 61; Form 3 filers, enter “0”) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

6 Total. Add lines 2 through 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

7 Amount of tax due. Subtract line 6 from line 1. Pay in full with this application. Note: If “0,” see below for information

regarding automatic extensions. You also have the option of filing Form M-8736 electronically. See below for more

information . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 7

Automatic Extension Granted if 100% Tax Due is Paid by Tax Return Due Date

If line 7 is “0” and 100% of the tax due for 2012 has been paid through: withholding; timely estimated payments of tax; credits from your

2012 return; or a refund from the prior tax year applied to the current year’s tax liability, you are no longer required to file Form M-8736,

Application for Automatic Extension of Time to File Massachusetts Income Tax Return. However, if you do choose to file Form M-8736

in this instance, you must do so electronically, via E-File or the Web. See

TIR 06-21

for more information.

Filing Your Extension Electronically (E-File or via the Web)

You also have the option of filing your extension via E-File or the Web. If there is a tax due with your extension, payment can be made

through Electronic Funds Withdrawal.

Visit to file via the Web.

Part 2. Complete If Prepared By Someone Other than Taxpayer

I am authorized to prepare this application and I am (select one):

a member in good standing of the bar of the highest court of (specify jurisdiction) ______________________________________________________

a certified public accountant, or public accountant, duly qualified to practice in (specify jurisdiction)_________________________________________

a person enrolled to practice before the Internal Revenue Service __________________________________________________________________

a duly authorized agent holding a power of attorney with respect to filing an extension of time (the power of attorney need not be submitted unless

requested) _____________________________________________________________________________________________________________

a person standing in close personal or business relationship to the taxpayer who is unable to sign this application because of illness, absence, or

other good cause; my relationship to the taxpayer and the reasons why the taxpayer is unable to sign this application are ______________________

______________________________________________________________________________________________________________________

Part 3. Sign Here

Under penalties of perjury, I declare that to the best of my knowledge and belief this return and enclosures are true, correct and complete. Declaration of

preparer (other than taxpayer) is based on all information of which he/she has knowledge.

Signature

Date

Paid preparer’s signature

SSN or PTIN

3

–

–

/

/

Title

Employer Identification number

Date

3

–

/

/

Write your Federal Identification number on lower left corner of check. Make check payable to Commonwealth of Massachusetts and mail to:

Massachusetts Department of Revenue, PO Box 7070, Boston, MA 02204.

1

1 2

2