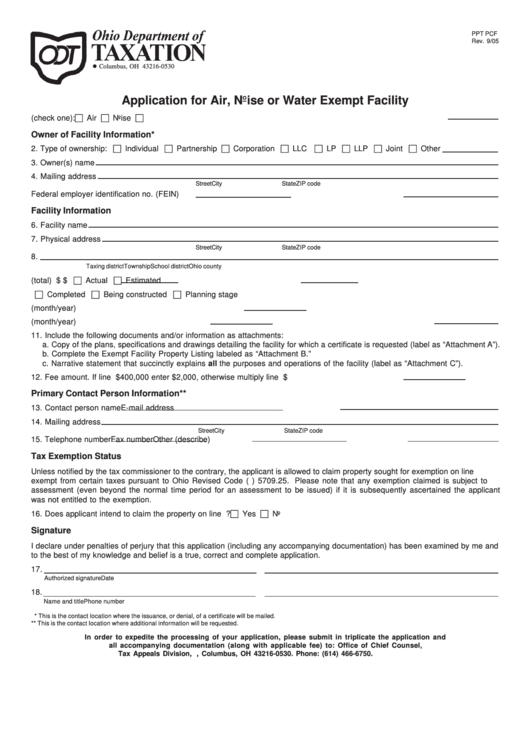

Reset Form

PPT PCF

Rev. 9/05

P.O. Box 530

Columbus, OH 43216-0530

Application for Air, Noise or Water Exempt Facility

1.a. Type of facility (check one):

Air

Noise

Water

1.b. Number of substantially similar facilities in county

Owner of Facility Information*

2. Type of ownership:

Individual

Partnership

Corporation

LLC

LP

LLP

Joint

Other

3. Owner(s) name

4. Mailing address

Street

City

State

ZIP code

5.a. Federal employer identification no. (FEIN)

5.b. Ohio charter or license no.

Facility Information

6. Facility name

7. Physical address

Street

City

State

ZIP code

8.

Taxing district

Township

School district

Ohio county

9.a. Facility cost (total) $

9.b. Cost sought for exemption $

9.c. Cost is

Actual

Estimated

10.a. Facility is

Completed

Being constructed

Planning stage

10.b. Date facility completed or estimated date (month/year)

10.c. Date facility construction began (month/year)

10.d. Provide applicable Ohio EPA permit no.

11. Include the following documents and/or information as attachments:

a. Copy of the plans, specifications and drawings detailing the facility for which a certificate is requested (label as “Attachment A”).

b. Complete the Exempt Facility Property Listing labeled as “Attachment B.”

c. Narrative statement that succinctly explains all the purposes and operations of the facility (label as “Attachment C”).

12. Fee amount. If line 9.a. is greater than $400,000 enter $2,000, otherwise multiply line 9.a. by 0.005 $

Primary Contact Person Information**

13. Contact person name

E-mail address

14. Mailing address

Street

City

State

ZIP code

15. Telephone number

Fax number

Other (describe)

Tax Exemption Status

Unless notified by the tax commissioner to the contrary, the applicant is allowed to claim property sought for exemption on line 9.b. as

exempt from certain taxes pursuant to Ohio Revised Code (R.C.) 5709.25. Please note that any exemption claimed is subject to

assessment (even beyond the normal time period for an assessment to be issued) if it is subsequently ascertained the applicant

was not entitled to the exemption.

16. Does applicant intend to claim the property on line 9.b. as exempt prior to the certificate being issued?

Yes

No

Signature

I declare under penalties of perjury that this application (including any accompanying documentation) has been examined by me and

to the best of my knowledge and belief is a true, correct and complete application.

17.

Authorized signature

Date

18.

Name and title

Phone number

* This is the contact location where the issuance, or denial, of a certificate will be mailed.

** This is the contact location where additional information will be requested.

In order to expedite the processing of your application, please submit in triplicate the application and

all accompanying documentation (along with applicable fee) to: Office of Chief Counsel,

Tax Appeals Division, P.O. Box 530, Columbus, OH 43216-0530. Phone: (614) 466-6750.

1

1 2

2 3

3