Form Cg-89 - Wholesale Dealer Of Cigarettes Informational Return

ADVERTISEMENT

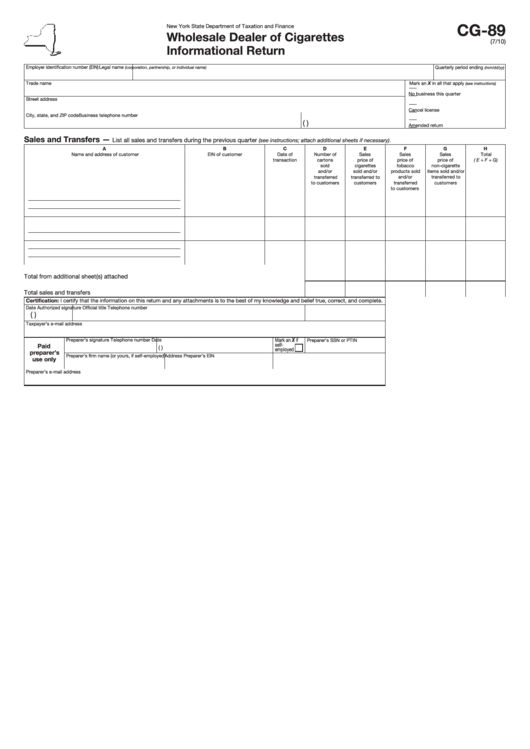

CG-89

New York State Department of Taxation and Finance

Wholesale Dealer of Cigarettes

(7/10)

Informational Return

Employer identification number (EIN)

Legal name

Quarterly period ending

(corporation, partnership, or individual name)

(mm/dd/yy)

Trade name

Mark an X in all that apply

(see instructions)

No business this quarter

Street address

Cancel license

City, state, and ZIP code

Business telephone number

(

)

Amended return

Sales and Transfers —

List all sales and transfers during the previous quarter

(see instructions; attach additional sheets if necessary).

A

B

C

D

E

F

G

H

Name and address of customer

EIN of customer

Date of

Number of

Sales

Sales

Sales

Total

transaction

cartons

price of

price of

price of

( E + F + G)

sold

cigarettes

tobacco

non-cigarette

and/or

sold and/or

products sold

items sold and/or

transferred

transferred to

and/or

transferred to

to customers

customers

transferred

customers

to customers

Total from additional sheet(s) attached ........................................................................................................

Total sales and transfers ...............................................................................................................................

Certification: I certify that the information on this return and any attachments is to the best of my knowledge and belief true, correct, and complete.

Date

Authorized signature

Official title

Telephone number

(

)

Taxpayer’s e-mail address

Mark an X if

Preparer’s signature

Telephone number

Date

Preparer’s SSN or PTIN

self-

Paid

(

)

employed

preparer’s

Preparer’s firm name (or yours, if self-employed) Address

Preparer’s EIN

use only

Preparer’s e-mail address

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2