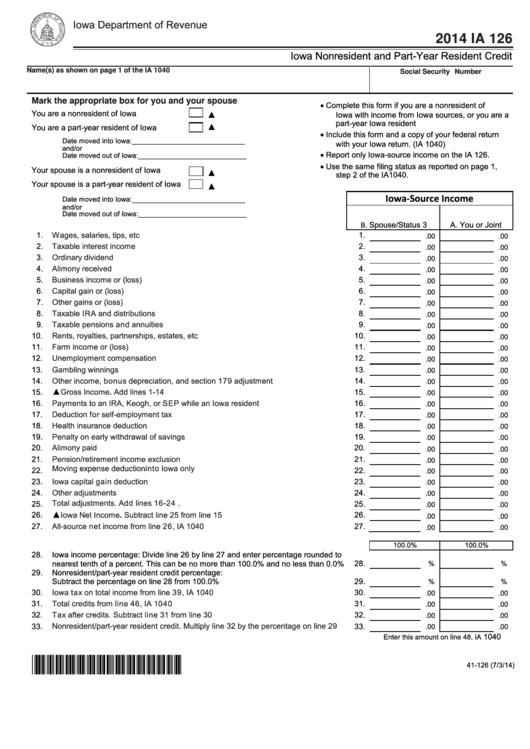

Iowa Department of Revenue

2014 IA 126

Iowa Nonresident and Part-Year Resident Credit

Name(s) as shown on page 1 of the IA 1040

Social Security Number

Mark the appropriate box for you and your spouse

Complete this form if you are a nonresident of

▲

Iowa with income from Iowa sources, or you are a

You are a nonresident of Iowa

part-year Iowa resident

▲

You are a part-year resident of Iowa

Include this form and a copy of your federal return

Date moved into Iowa:_____________________________

with your Iowa return. (IA 1040)

and/or

Report only Iowa-source income on the IA 126.

Date moved out of Iowa:____________________________

Use the same filing status as reported on page 1,

Your spouse is a nonresident of Iowa

▲

step 2 of the IA1040.

Your spouse is a part-year resident of Iowa

▲

Iowa-Source Income

Date moved into Iowa:_____________________________

and/or

Date moved out of Iowa:____________________________

Spouse/Status 3

A. You or Joint

B.

1.

1.

Wages, salaries, tips, e t c . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

.00

.00

2.

Taxable interest income ...................................................................................................

2.

.00

.00

3.

Ordinary dividend .............................................................................................................

3.

.00

.00

4.

Alimony received ..............................................................................................................

4.

.00

.00

5.

Business income or (l os s ) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5.

.00

.00

6.

Capital gain or (loss) ...............................................................................

6.

.00

.00

7.

Other gains or (loss) ...................................................................................

7.

.00

.00

8.

Taxable IRA and distributions ................................................................

8.

.00

.00

9.

Taxable pensions and annuities.......................................................................................

9.

.00

.00

10.

Rents, royalties, partnerships, estates, etc ..................................................

10.

.00

.00

11.

Farm income or (loss) .....................................................................................

11.

.00

.00

12.

Unemployment compensation ..................................................................................

12.

.00

.00

13.

Gambling winnings ..........................................................................................................

13.

.00

.00

14.

Other income, bonus depreciation, and section 179 adjustment ...............................

14.

.00

.00

▲

15.

Gross Income. Add lines 1-14 .....................................................................

15.

.00

.00

16.

Payments to an IRA, Keogh, or SEP while an Iowa resident .............................

16.

.00

.00

17.

Deduction for self-employment tax ...............................................................................

17.

.00

.00

18.

Health insurance deduction ...........................................................................................

18.

.00

.00

19.

Penalty on early withdrawal of savings .........................................................................

19.

.00

.00

20.

Alimony paid .....................................................................................................

20.

.00

.00

21.

Pension/retirement income exclusion ............................................................................

21.

.00

.00

22.

Moving expense deduction into Iowa only ...................................................................

22.

.00

.00

23.

Iowa capital gain deduction ...........................................................................................

23.

.00

.00

24.

Other adjustments .............................................................................................

24.

.00

.00

Total adjustments. Add lines 16-24 .................................................................

25.

25.

.00

.00

▲

26.

Iowa Net Income. Subtract line 25 from line 15 ......................................................

26.

.00

.00

27.

All-source net income from line 26, IA 1040 ..............................................................

27.

.00

.00

100.0%

100.0%

28.

Iowa income percentage: Divide line 26 by line 27 and enter percentage rounded to

nearest tenth of a percent. This can be no more than 100.0% and no less than 0.0%

28.

%

%

29.

Nonresident/part-year resident credit percentage:

Subtract the percentage on line 28 from 100.0% ..........................................................

29.

%

%

30.

Iowa tax on total income from line 39, IA 1040 ......................................................

30.

.00

.00

31.

Total credits from line 46, IA 1040 ...........................................................................

31.

.00

.00

32.

Tax after credits. Subtract line 31 from line 30 ..............................................

32.

.00

.00

Nonresident/part-year resident credit. Multiply line 32 by the percentage on line 29

33.

33.

.00

.00

1040

Enter this amount on line 48, IA

*1441126019999*

41-126 (7/3/14)

1

1