Form St-51 - Information For Expanded Temporary Storage Applicants And Permit Holders

ADVERTISEMENT

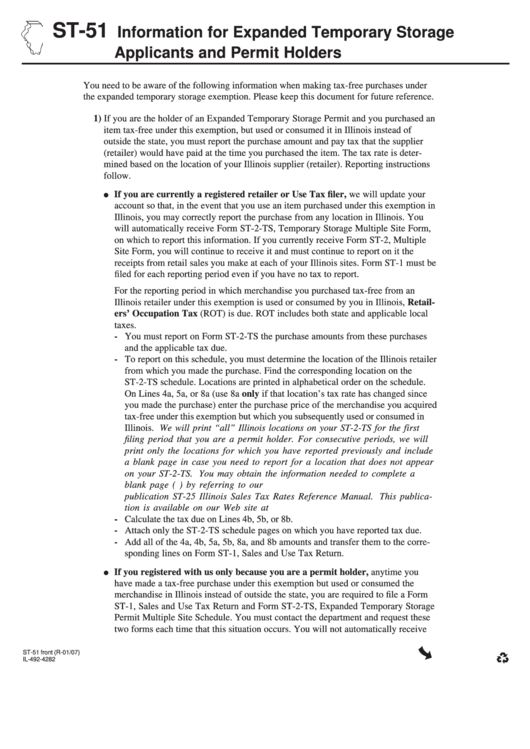

ST-51

Information for Expanded Temporary Storage

Applicants and Permit Holders

You need to be aware of the following information when making tax-free purchases under

the expanded temporary storage exemption. Please keep this document for future reference.

1) If you are the holder of an Expanded Temporary Storage Permit and you purchased an

item tax-free under this exemption, but used or consumed it in Illinois instead of

outside the state, you must report the purchase amount and pay tax that the supplier

(retailer) would have paid at the time you purchased the item. The tax rate is deter-

mined based on the location of your Illinois supplier (retailer). Reporting instructions

follow.

If you are currently a registered retailer or Use Tax filer, we will update your

●

account so that, in the event that you use an item purchased under this exemption in

Illinois, you may correctly report the purchase from any location in Illinois. You

will automatically receive Form ST-2-TS, Temporary Storage Multiple Site Form,

on which to report this information. If you currently receive Form ST-2, Multiple

Site Form, you will continue to receive it and must continue to report on it the

receipts from retail sales you make at each of your Illinois sites. Form ST-1 must be

filed for each reporting period even if you have no tax to report.

For the reporting period in which merchandise you purchased tax-free from an

Illinois retailer under this exemption is used or consumed by you in Illinois, Retail-

ers’ Occupation Tax (ROT) is due. ROT includes both state and applicable local

taxes.

- You must report on Form ST-2-TS the purchase amounts from these purchases

and the applicable tax due.

- To report on this schedule, you must determine the location of the Illinois retailer

from which you made the purchase. Find the corresponding location on the

ST-2-TS schedule. Locations are printed in alphabetical order on the schedule.

On Lines 4a, 5a, or 8a (use 8a only if that location’s tax rate has changed since

you made the purchase) enter the purchase price of the merchandise you acquired

tax-free under this exemption but which you subsequently used or consumed in

Illinois. We will print “all” Illinois locations on your ST-2-TS for the first

filing period that you are a permit holder. For consecutive periods, we will

print only the locations for which you have reported previously and include

a blank page in case you need to report for a location that does not appear

on your ST-2-TS. You may obtain the information needed to complete a

blank page (e.g. taxable location code and tax rate) by referring to our

publication ST-25 Illinois Sales Tax Rates Reference Manual. This publica-

tion is available on our Web site at

- Calculate the tax due on Lines 4b, 5b, or 8b.

- Attach only the ST-2-TS schedule pages on which you have reported tax due.

- Add all of the 4a, 4b, 5a, 5b, 8a, and 8b amounts and transfer them to the corre-

sponding lines on Form ST-1, Sales and Use Tax Return.

If you registered with us only because you are a permit holder, anytime you

●

have made a tax-free purchase under this exemption but used or consumed the

merchandise in Illinois instead of outside the state, you are required to file a Form

ST-1, Sales and Use Tax Return and Form ST-2-TS, Expanded Temporary Storage

Permit Multiple Site Schedule. You must contact the department and request these

two forms each time that this situation occurs. You will not automatically receive

ST-51 front (R-01/07)

IL-492-4282

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2