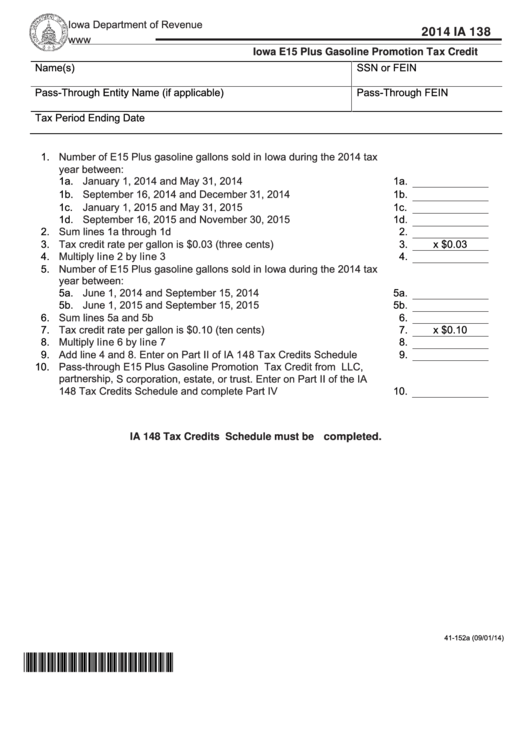

Iowa Department of Revenue

2014 IA 138

Iowa E15 Plus Gasoline Promotion Tax Credit

Name(s)

SSN or FEIN

Pass-Through Entity Name (if applicable)

Pass-Through FEIN

Tax Period Ending Date

1.

Number of E15 Plus gasoline gallons sold in Iowa during the 2014 tax

year between:

1a.

January 1, 2014 and May 31, 2014 ................................................

1a.

1b.

September 16, 2014 and December 31, 2014 ................................

1b.

1c.

January 1, 2015 and May 31, 2015 ................................................

1c.

1d.

September 16, 2015 and November 30, 2015 ................................

1d.

2.

Sum lines 1a through 1d .........................................................................

2.

3.

Tax credit rate per gallon is $0.03 (three cents) .....................................

3.

x $0.03

4.

Multiply line 2 by line 3 ........................................................

4.

5.

Number of E15 Plus gasoline gallons sold in Iowa during the 2014 tax

year between:

5a.

June 1, 2014 and September 15, 2014 ...........................................

5a.

5b.

June 1, 2015 and September 15, 2015 ...........................................

5b.

6.

Sum lines 5a and 5b ...............................................................................

6.

7.

Tax credit rate per gallon is $0.10 (ten cents) .........................................

7.

x $0.10

8.

Multiply line 6 by line 7 ........................................................

8.

9.

Add line 4 and 8. Enter on Part II of IA 148 Tax Credits Schedule

9.

10.

Pass-through E15 Plus Gasoline Promotion Tax Credit from LLC,

partnership, S corporation, estate, or trust. Enter on Part II of the IA

148 Tax Credits Schedule and complete Part IV ....................................

10.

IA 148 Tax Credits Schedule must be completed.

41-152a (09/01/14)

*1441152019999*

1

1 2

2