General Information for ST3 TL

If you have an existing fi xed place of business and are moving

address as shown on the permit. If you move to a new loca-

to a new location not within the same county, you must

tion within the same county, you must contact the Ohio

cancel your vendor’s license and obtain a new vendor’s

Department of Commerce, Division of Liquor Control,

license from the county auditor where your new place of

to have the permit transferred to the new location ad-

business will be located or apply online at Ohio Business

dress. The Department of Taxation will not issue a transfer

Gateway (obg.ohio.gov). To cancel your vendor’s license,

license until we have been notifi ed by the Ohio Department

you must fi le a fi nal sales tax return and you must indicate

of Commerce, Division of Liquor Control, that the permit has

your last day of business.

been transferred.

If you hold a permit issued by the Ohio Department of Com-

NOTE: This form should be used to request a “Transfer

merce, Division of Liquor Control, the vendor’s license and

of Vendor’s License” ONLY. For all other changes, please

permit must have the identical name and be for the identical

use form ST 3C.

Reset Form

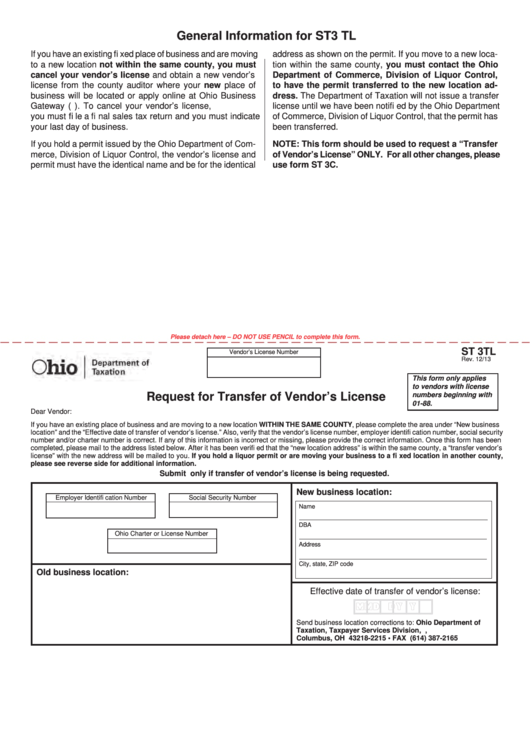

Please detach here – DO NOT USE PENCIL to complete this form.

ST 3TL

Vendor’s License Number

Rev. 12/13

This form only applies

to vendors with license

Request for Transfer of Vendor’s License

numbers beginning with

01-88.

Dear Vendor:

If you have an existing place of business and are moving to a new location WITHIN THE SAME COUNTY, please complete the area under “New business

location” and the “Effective date of transfer of vendor’s license.” Also, verify that the vendor’s license number, employer identifi cation number, social security

number and/or charter number is correct. If any of this information is incorrect or missing, please provide the correct information. Once this form has been

completed, please mail to the address listed below. After it has been verifi ed that the “new location address” is within the same county, a “transfer vendor’s

license” with the new address will be mailed to you. If you hold a liquor permit or are moving your business to a fi xed location in another county,

please see reverse side for additional information.

Submit only if transfer of vendor’s license is being requested.

New business location:

Employer Identifi cation Number

Social Security Number

Name

DBA

Ohio Charter or License Number

Address

City, state, ZIP code

Old business location:

Effective date of transfer of vendor’s license:

M M D D Y Y

Send business location corrections to: Ohio Department of

Taxation, Taxpayer Services Division, P.O. Box 182215,

Columbus, OH 43218-2215 • FAX (614) 387-2165

1

1