Form B-A-111 - Application To Designate An Integrated Wholesale Dealer By A Manufacturer For Other Tobacco Products

ADVERTISEMENT

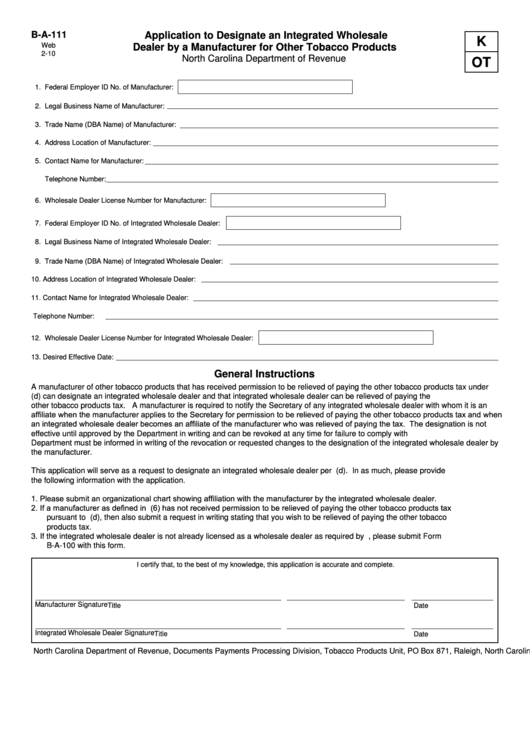

B-A-111

Application to Designate an Integrated Wholesale

K

Web

Dealer by a Manufacturer for Other Tobacco Products

2-10

North Carolina Department of Revenue

OT

1. Federal Employer ID No. of Manufacturer:

2. Legal Business Name of Manufacturer:

3. Trade Name (DBA Name) of Manufacturer:

4. Address Location of Manufacturer:

5. Contact Name for Manufacturer:

Telephone Number:

6. Wholesale Dealer License Number for Manufacturer:

7. Federal Employer ID No. of Integrated Wholesale Dealer:

8. Legal Business Name of Integrated Wholesale Dealer:

9. Trade Name (DBA Name) of Integrated Wholesale Dealer:

10. Address Location of Integrated Wholesale Dealer:

11. Contact Name for Integrated Wholesale Dealer:

Telephone Number:

12. Wholesale Dealer License Number for Integrated Wholesale Dealer:

13. Desired Effective Date:

General Instructions

A manufacturer of other tobacco products that has received permission to be relieved of paying the other tobacco products tax under

G.S. 105-113.35(d) can designate an integrated wholesale dealer and that integrated wholesale dealer can be relieved of paying the

other tobacco products tax. A manufacturer is required to notify the Secretary of any integrated wholesale dealer with whom it is an

affiliate when the manufacturer applies to the Secretary for permission to be relieved of paying the other tobacco products tax and when

an integrated wholesale dealer becomes an affiliate of the manufacturer who was relieved of paying the tax. The designation is not

effective until approved by the Department in writing and can be revoked at any time for failure to comply with G.S. 105-113.35. The

Department must be informed in writing of the revocation or requested changes to the designation of the integrated wholesale dealer by

the manufacturer.

This application will serve as a request to designate an integrated wholesale dealer per G.S. 105-113.35(d). In as much, please provide

the following information with the application.

1.

Please submit an organizational chart showing affiliation with the manufacturer by the integrated wholesale dealer.

2.

If a manufacturer as defined in G.S. 105-113.4(6) has not received permission to be relieved of paying the other tobacco products tax

pursuant to G.S. 105-113.35(d), then also submit a request in writing stating that you wish to be relieved of paying the other tobacco

products tax.

3.

If the integrated wholesale dealer is not already licensed as a wholesale dealer as required by G.S. 105-113.36, please submit Form

B-A-100 with this form.

I certify that, to the best of my knowledge, this application is accurate and complete.

Manufacturer Signature

Title

Date

Integrated Wholesale Dealer Signature

Title

Date

North Carolina Department of Revenue, Documents Payments Processing Division, Tobacco Products Unit, PO Box 871, Raleigh, North Carolina 27602

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1